The Wine Choke

I was standing in my kitchen—my beautiful, newly renovated kitchen that I'd waited forty years to afford—when Melissa said something that made me nearly spit Pinot Grigio all over the marble countertops. We were talking about the backsplash, which I'd agonized over for weeks, and she was running her hand along the subway tiles when she said it: 'I mean, it looks nice, Mom, but this is basically my money you're spending.' I actually laughed at first because surely she was joking. She had to be joking, right? But when I looked at her face, there wasn't a trace of humor there. Just this casual expectation, like she'd stated something as obvious as the weather. I set down my wine glass before I could drop it. My daughter—my thirty-eight-year-old daughter who I'd raised and loved and supported through everything—was standing in my home, looking at my retirement savings like it was already hers. The strangest part? She wasn't embarrassed about saying it out loud. Her face told me she wasn't joking—and I realized my daughter saw me as a bank account with an expiration date.

Image by RM AI

Image by RM AI

Forty Years of Backbreaking Work

That night, I couldn't sleep. I kept thinking about what Melissa had said, trying to make sense of it. So I did what I always do when I'm upset—I made tea and sat at my kitchen table, the one I'd bought secondhand thirty years ago and only just replaced. Forty years. That's how long I'd worked as a nurse, starting when Melissa was still in diapers. Double shifts, overnight rotations, weekends, holidays—I did them all. I worked the Christmas morning when Melissa was seven and woke up without me there. I missed her high school graduation rehearsal because someone had to cover the ER. I ate vending machine dinners and wore shoes until they had holes because every extra dollar went into savings or into raising her. My back aches every morning now, a souvenir from decades of lifting patients and standing on concrete floors. My retirement fund wasn't some lucky windfall—it was built from sacrificed sleep, missed moments, and years of my physical body breaking down in service to others. I had worked Christmas mornings and missed birthdays—but apparently, that made me selfish for wanting to enjoy the result.

Image by RM AI

Image by RM AI

The Passion Projects

The thing is, Melissa had never really settled into anything. I tried not to judge, I really did, but by thirty-eight, you'd think there'd be some stability. She'd been a yoga instructor, then a 'wellness consultant,' then she tried selling essential oils for a while. Each job came with a story about how this was finally 'her calling,' and each one fizzled out within a year. Then she married Kyle, who was somehow even worse about follow-through. Kyle always had these big ideas—a food truck, a podcast, some kind of app that never quite made sense when he explained it. They were always six months away from their big break, always needing just a little help to get there. And I'd helped. God, had I helped. Security deposits when they got evicted. Credit card payments when things got 'temporarily tight.' Grocery money. Car repairs. I told myself I was being supportive, that parents help their kids. But looking back now, I could see the pattern I'd been too close to recognize. I had bailed them out before—security deposits, credit cards, groceries—but this time felt different.

Image by RM AI

Image by RM AI

Must Be Nice

After the kitchen comment, I started noticing things I'd dismissed before. Little remarks Melissa would drop into conversation, casual as anything. When I mentioned replacing my twelve-year-old car, she said, 'Must be nice to just buy whatever you want.' When I bought new living room furniture—nothing fancy, just comfortable pieces that didn't hurt my back—she walked through and said, 'Hope you're not blowing through it all.' At first, I chalked it up to envy. Maybe she was struggling financially and feeling sensitive about my retirement. I could understand that. I tried to be less obvious about my purchases around her, which is insane when you think about it—hiding my own spending in my own home. But the comments didn't stop. They got more frequent, actually. Every time I mentioned doing something for myself, there was a little jab. A raised eyebrow. A sigh. I started keeping track mentally, not on purpose exactly, but you know how it is when something bothers you. At first I brushed it off as envy, but the comments kept coming, each one a little sharper than the last.

Image by RM AI

Image by RM AI

The Cruise Invitation

I thought maybe we just needed quality time together, away from the stress of daily life. So when I saw the cruise deal—seven days in the Caribbean—I booked it for all three of us. Melissa, Kyle, and me. It wasn't cheap, but I figured this was exactly what retirement money was for: making memories with family. I covered everything. The flights, the cabins (I got them their own room, obviously), even the drink packages and shore excursions. When I told Melissa, she seemed excited, or at least I thought she was. She hugged me and said it would be 'amazing,' and for a moment, I felt like we were back on solid ground. I spent weeks looking forward to it, planning which excursions we'd do together, imagining us laughing over dinner, maybe actually talking without tension for once. I bought a new swimsuit and actually felt optimistic. Maybe this would reset things between us. Maybe she just needed to see that I wanted to share my retirement with her, not hoard it away. I paid for everything—flights, cabins, excursions—thinking generosity would bring us closer, not push us apart.

Image by RM AI

Image by RM AI

The Twenty-Dollar Cocktail

The cruise started out fine. The first two days were actually nice—we had breakfast together, did a snorkeling excursion, took photos by the pool. I was starting to think my plan had worked. Then came Day Three. I was lying on a deck chair in my new swimsuit, finally feeling relaxed for the first time in months. The sun was perfect, the water was impossibly blue, and I decided to treat myself to one of those fancy frozen cocktails they bring around. Twenty dollars, which felt steep, but I was on vacation. I was watching the ocean when I heard Melissa say something to Kyle. She wasn't whispering exactly, but her voice had that tone—the one you use when you want someone to hear you without directly confronting them. 'That's about twenty dollars less I'll inherit.' I froze with the drink halfway to my lips. Kyle made some noncommittal noise, and I turned to look at her. She was staring at my cocktail like it had personally offended her. She wasn't joking—she was calculating my spending like an accountant tracking a dwindling trust fund.

Image by RM AI

Image by RM AI

The Financial Advisor

I cut the cruise short in my head after that, though we still had four days left. When I got home, I couldn't shake what had happened. I called Richard, my financial advisor—I'd been working with him for about fifteen years, and he'd helped me plan my retirement down to the detail. When I walked into his office, I probably looked as rattled as I felt. I explained the kitchen comment, the cruise remark, all the little jabs that had been building up. Richard is normally very composed, very professional, but as I talked, his expression changed. He set down his pen and looked at me with something like concern, maybe even pity. 'Linda,' he said carefully, 'I need to ask you something. Has Melissa ever directly asked about the amount in your accounts?' I said no, not directly. He nodded slowly, like he was confirming something he'd suspected. 'I've seen this pattern before,' he said quietly. When I described what Melissa had said, Richard's face went pale—apparently, he'd seen this before.

Image by RM AI

Image by RM AI

Italy Plans

I tried to pretend things were normal for a few weeks. I invited Melissa over for dinner, kept the conversation light, didn't mention money or plans or anything that might trigger another comment. Then my nursing school friend Karen called about a trip to Italy she was organizing. A week in Tuscany, something we'd talked about doing for years. The timing was perfect, the price was reasonable, and I was actually excited about it. I mentioned it to Melissa almost without thinking, just casual conversation over coffee. Her reaction was immediate. She put down her mug hard enough that coffee sloshed over the rim. 'Another trip? Seriously?' Her voice had an edge I'd never heard before, sharp and cold. 'So you're just going to drain everything before we ever see a dime?' The words hung in the air between us. We ever see a dime. Not 'before you can enjoy it' or 'before you're too old to travel.' Before WE ever see a dime. 'So you're just going to drain everything before we ever see a dime?' she snapped, and I felt something inside me shift.

Image by RM AI

Image by RM AI

Coffee with Patricia

I needed to talk to someone before I completely lost my mind. Patricia had been my friend since we were both young nurses working night shifts, sharing complaints about demanding patients and dreams about retirement. She knew me, really knew me, and I trusted her not to sugarcoat things. We met at our usual coffee shop on Tuesday morning. I told her everything—the 'inheritance' comment, the Italy trip reaction, the pattern I was starting to see. Patricia listened quietly, her espresso sitting untouched, her face growing more serious with every detail. She didn't interrupt, didn't offer platitudes. When I finished, she was quiet for a long moment, just looking at me with this expression I couldn't quite read. It wasn't pity exactly, more like recognition. Like she'd heard this story before. 'Linda,' she said carefully, 'I don't want to alarm you, but...' She trailed off, choosing her words with obvious care. Then she reached across the table and squeezed my hand. 'You know what this sounds like, don't you?'

Image by RM AI

Image by RM AI

The Sobbing Call

Two days later, Melissa called me sobbing. I mean really sobbing—gasping, hiccupping, barely coherent. My first instinct was pure panic. Someone died, someone's hurt, something terrible happened. It took me five minutes to calm her down enough to understand what she was saying. Kyle's 'business opportunity' had fallen through. Some online coaching platform he'd invested their savings in, promising passive income and financial freedom. Collapsed overnight. The money was gone. They were behind on rent again, maxed out on credit cards, facing late fees and disconnection notices. My heart hurt for her, it really did. Nobody wants to see their child struggling like that. But then, in the middle of her tears, she said something that made my stomach drop. 'We wouldn't be this stressed if we just had some of what's coming to us,' she said through sobs.

Image by RM AI

Image by RM AI

What's Coming to You

I had to ask. I couldn't let it slide this time. 'Melissa,' I said slowly, keeping my voice gentle, 'what do you mean by what's coming to you?' There was a pause on the other end of the line. A shift in the quality of her breathing. When she spoke again, the sobbing had stopped. Her voice was flat, almost businesslike. 'My inheritance,' she said, like it was the most obvious thing in the world. Not 'when you're gone someday' or 'eventually, in the future.' Just my inheritance. Present tense. Definite article. Like it was already sitting in an account with her name on it, and I was just inconveniently still breathing. The silence stretched between us. I stood in my kitchen, phone pressed to my ear, and felt something cold settle into my chest. 'My inheritance,' Melissa said flatly, as if it were already hers—as if I were already gone.

Image by RM AI

Image by RM AI

Fine

I made a decision right there on that phone call. If Melissa wanted to treat my life savings as her money, if she was already counting it and resenting me for spending it, then fine. She could have it. But not the way she expected. Not as some reward for outliving me. Not as payment for putting up with her aging mother. If she wanted this inheritance so badly, she was going to earn it. She was going to prove she could handle it responsibly. The clarity was almost exhilarating. For weeks I'd been hurt and confused, trying to figure out how to respond. Now I knew exactly what to do. 'Fine,' I said calmly, interrupting whatever she was saying. 'You can have it—on one condition.' The silence on the phone was electric.

Image by RM AI

Image by RM AI

Image by RM AI

Image by RM AI

The Appointment

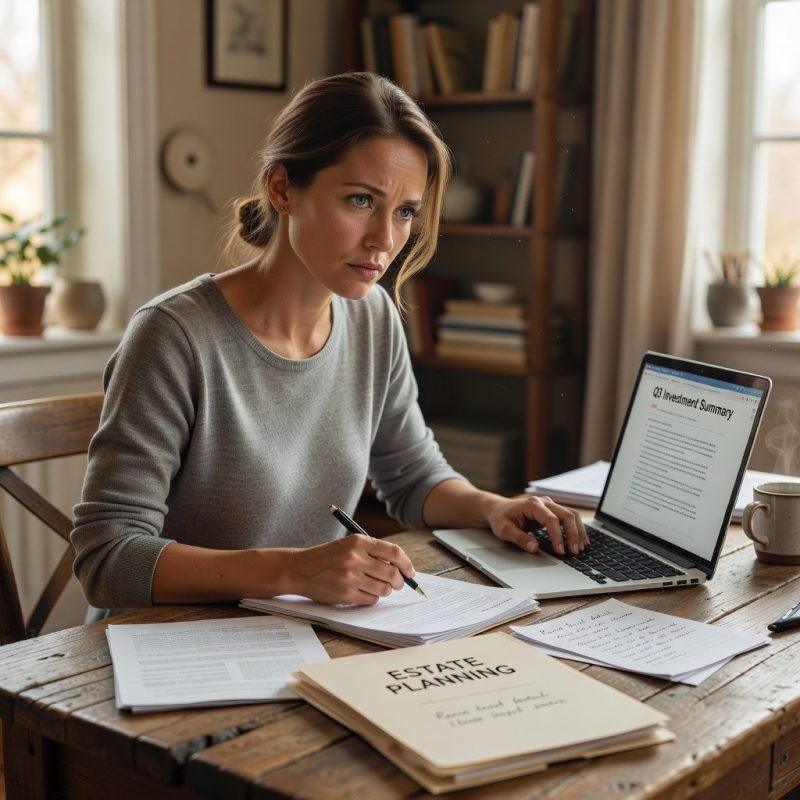

I didn't sleep that night. But it wasn't the anxious, spiraling insomnia I'd been having. This was different—focused, productive. I sat at my kitchen table with my laptop and a legal pad, making lists. I called Richard first thing in the morning. He's Patricia's husband, an estate attorney who'd helped me update my will a few years back. I explained what I wanted to do. He listened carefully, asked clarifying questions, and didn't judge. 'A conditional trust,' he said thoughtfully. 'It's unusual, but it's absolutely legal. We can structure it however you want.' We spent three hours on the phone working out the details. Employment requirements. Financial education components. Matching fund provisions. Accountability measures. Every condition designed to ensure Melissa would actually be capable of managing money before she got any. By the time we finished, I had a complete framework. I didn't cry and I didn't rage—I made a list, and for the first time in weeks, I felt clear-headed.

Image by RM AI

Image by RM AI

Hopeful and Smug

I invited Melissa and Kyle over for Sunday dinner. 'To discuss the financial help you need,' I told her on the phone. She arrived early, which never happened. Kyle was with her, dressed more neatly than usual, his hair actually combed. They both had this energy about them—hopeful, expectant, almost gleeful. Like they'd already decided how this conversation would go. Like they'd won some negotiation I didn't even know we were having. Melissa kept glancing at Kyle with these little smiles. He squeezed her hand encouragingly. When I offered them coffee, they both declined, too eager to wait. 'So,' Melissa said, settling into her chair with barely concealed impatience, 'you said you wanted to talk about helping us?' Kyle leaned forward, nodding earnestly. They sat down at my dining table with barely concealed excitement, like children on Christmas morning.

Image by RM AI

Image by RM AI

Three Requirements

I pulled out the folder Richard had prepared. Three copies of the trust document, neatly stapled. I slid one across to each of them. 'I've established a trust for you,' I said calmly. 'It will release funds quarterly, but only if you meet three requirements.' I watched their faces as I explained. First requirement: both of them had to maintain full-time employment for at least six consecutive months. Real jobs, with paychecks and taxes, not 'opportunities' or 'ventures.' Second requirement: completion of a financial literacy course, with certification. Third requirement: for every dollar released from the trust, they had to have saved one dollar themselves in a verified account. Matching funds. Proof of fiscal responsibility. Kyle's smile had already faded. Melissa was staring at the papers like they were written in another language. 'There are also provisions for accountability,' I continued. 'Monthly financial reports. No major purchases without trustee approval. The trust can be revoked if conditions aren't met.' With each requirement, I watched Melissa's smile crack a little more—until it shattered completely.

Image by RM AI

Image by RM AI

You're Kidding

Melissa's face went from confusion to understanding to rage in about ten seconds flat. 'You're kidding,' she said, her voice rising. 'This is... you can't be serious.' Kyle was flipping through the papers, shaking his head. 'This is control,' he said, looking up at me with real anger. 'This is you trying to manipulate us.' Melissa stood up, the chair scraping loudly against my floor. 'You're treating us like children! Like we're incompetent!' Her voice was shaking now, but not with tears. With fury. 'You can't control it like that! It's supposed to be ours!' I stayed seated, kept my voice level. This was the moment. This was where I either backed down like I'd been doing my whole life as a mother, or I held firm. 'It's my money,' I said softly, meeting her eyes. 'I absolutely can.'

Image by RM AI

Image by RM AI

The Charity Option

I'd saved one more detail for the end. The real one. I folded my hands on the table and looked at both of them. 'If you refuse these terms, or if you don't complete them, everything goes to charity when I die,' I said. 'The Literacy Foundation. Women's shelter. Cancer research. I've already drafted that version with James too.' The silence was different this time. Heavier. Kyle stopped flipping through the papers. Melissa's face had gone pale. 'You wouldn't,' she whispered, and I could hear something cracking in her voice. Not sadness. Fear. The fear of losing what she'd already spent in her mind. I met her eyes and didn't blink. I'd spent two weeks getting to this point, working through my own guilt and doubt, and I wasn't backing down now. 'I absolutely would,' I said quietly. And that's when she realized I wasn't the same mother who'd written checks without questions, who'd smoothed over every conflict, who'd prioritized peace over boundaries. They left ten minutes later, Kyle slamming my door hard enough that my neighbor's dog started barking. 'You wouldn't,' Melissa whispered, but when our eyes met, she realized I absolutely would.

Image by RM AI

Image by RM AI

The Smear Campaign

The phone calls started the next day. First my cousin Janet, asking if I was 'okay' in that careful voice people use when they think you're losing it. Then my sister's friend Carol, who I hadn't spoken to in three years, suddenly concerned about my 'situation.' By day three, I understood what was happening. Melissa was working the family network, telling her version of events. I wasn't setting reasonable boundaries—I was 'withholding what's rightfully hers.' I wasn't protecting my retirement—I was being 'controlling and vindictive.' The story she was selling painted me as the villain in a family drama, the cruel mother punishing her struggling daughter. My aunt Ruth called and actually cried on the phone, begging me to 'make peace' with Melissa. I tried explaining what had actually been said, but I could hear the doubt in Ruth's voice. Melissa had gotten there first, and first impressions stick. I stopped answering calls I didn't recognize. Stopped checking Facebook where distant relatives were probably discussing it. I sat in my quiet house and reminded myself that I wasn't crazy, that boundaries weren't cruelty, that protecting myself wasn't betrayal. My phone wouldn't stop ringing—cousins, aunts, old friends—all asking if I'd really cut off my own daughter.

Image by RM AI

Image by RM AI

David's Visit

David showed up on a Thursday evening without calling first. He's my brother's son, mid-forties, the kind of guy who actually listens when people talk. I hadn't seen him since Christmas. 'Can I come in?' he asked, and something in his face told me this wasn't a social call. We sat in my kitchen with coffee neither of us drank. 'I've been hearing things,' he said carefully. 'About you and Melissa. About inheritance stuff.' I felt my shoulders tense. Another family member coming to tell me I was wrong. But David surprised me. 'I want to hear your side,' he said. So I told him. Everything. The 'my inheritance' comment, the terms, the charity clause, the family campaign. He listened without interrupting, his expression getting more thoughtful. 'That tracks,' he finally said. I blinked. 'What tracks?' He looked uncomfortable. 'Melissa's been... around more lately. Visiting people. Asking questions.' My stomach did something unpleasant. 'What kind of questions?' David shifted in his chair, choosing words carefully. When I explained what Melissa had actually said, David went quiet for a long time—then asked if I'd noticed anything strange about her visits to Grandma Helen.

Image by RM AI

Image by RM AI

Grandma Helen

David explained it slowly, like he was still working it out himself. Grandma Helen, my ex-husband's mother, was ninety-one and living in an assisted care facility. Still sharp, still independent with her finances. And apparently, Melissa had been visiting her every week for the past two months. 'Helen mentioned it to me last time I saw her,' David said. 'She seemed happy about it at first. Then confused.' Confused how? 'Melissa kept asking about her estate. Who was handling it, what the plan was, whether she'd updated anything recently. Helen thought maybe you'd asked her to check on things, make sure everything was in order.' My coffee had gone cold in my hands. 'I didn't ask her to do anything.' David nodded slowly. 'That's what I figured.' He told me Helen had seemed uncomfortable by the third visit, like Melissa wasn't there to visit—she was there to assess. To calculate. To inventory. I felt something cold settling in my chest. This wasn't just about my retirement money. This was a pattern I hadn't seen. David said Helen seemed confused about why Melissa suddenly cared so much—'It was like she was taking inventory,' he said.

Image by RM AI

Image by RM AI

Two Weeks Later

Two weeks of silence. No calls from Melissa, no texts, no messages through relatives. I'd started to think maybe that was it—maybe she'd decided the terms were too much, maybe she'd just walk away. Then my phone rang on a Tuesday afternoon. 'Mom.' Her voice was calm. Professional, almost. 'I need to know where I can enroll in a financial literacy course. A real one, certified, that meets your requirements.' I'd been loading the dishwasher. I stopped, held the phone tighter. 'You're serious?' 'I'm serious. Send me the information.' No apology. No acknowledgment of what she'd said or how she'd behaved. Just practical next steps. I should have felt relieved, maybe even hopeful. She was complying. She was meeting the terms. But something felt off. The tone was too controlled, too calculated. Like she'd spent those two weeks strategizing instead of reflecting. 'I'll email you some options,' I said carefully. 'Okay. Thanks.' She hung up before I could say anything else. I stood in my kitchen, phone in hand, trying to understand what had just happened. Her voice was different—not warm, but practical—and I realized she'd made a calculation I hadn't expected.

Image by RM AI

Image by RM AI

The Enrollment

I sent her three accredited programs the next day. Two local community colleges, one online certification through a university. All legitimate, all meeting the financial literacy requirement I'd specified in the trust terms. She replied within an hour. 'Got it. I'll start with the online one—fits my schedule better. When does the clock start?' The clock. Like this was a game show, not a fundamental shift in how she understood money and responsibility. I typed and deleted three different responses before settling on: 'Once you're officially enrolled and I have documentation.' She sent back a thumbs up emoji. That was it. No questions about the content, no conversation about why this mattered, no acknowledgment that maybe she needed to learn this stuff. Just logistics. I stared at my phone, feeling that same unease from her phone call. She was doing exactly what I'd asked. Following the rules I'd set. So why did I feel like I was playing checkers while she was playing chess? I gave her the information without gloating, but something in her tone made me wonder if she'd found a loophole I hadn't considered.

Image by RM AI

Image by RM AI

Patricia's Warning

Patricia came over that weekend with wine and her usual directness. 'So she's enrolled?' she asked, settling into my couch. 'Starting next week.' 'And you're worried.' It wasn't a question. Patricia has known me too long. I poured us both a glass and tried to explain the feeling I couldn't shake. How Melissa's compliance felt performative. How she'd shifted gears too quickly, too smoothly. How there were no apologies, no real conversations, just strategic movements. 'She's doing exactly what you asked,' I said. 'So why does it feel wrong?' Patricia sipped her wine, thinking. 'Because motivation matters,' she finally said. 'You wanted her to understand why this was necessary. To grow up. To see you as a person, not an ATM. Instead, she's treating this like an obstacle course.' That was exactly it. The forms without the transformation. The compliance without the understanding. 'Don't let your guard down,' Patricia said, and her voice was serious now. 'People don't change overnight. Real change is messy and slow and full of backsliding. This?' She gestured with her wine glass. 'This is too clean.' 'She's playing by your rules now,' Patricia said carefully, 'but that doesn't mean she's playing your game.'

Image by RM AI

Image by RM AI

The Job Search

The job applications started appearing in my email a week later. Melissa sent screenshots—submitted applications to retail management positions, administrative roles, customer service jobs. Each email had a subject line with a number. 'Application #3.' 'Application #7.' 'Application #12.' Like she was documenting every step for an audit. Then came the interview schedules. 'Phone interview Tuesday 2pm.' 'In-person Wednesday 10am.' Always brief, always informational, never conversational. No 'how are you,' no 'this is harder than I thought,' no vulnerability. Just proof of compliance. I should have been pleased. She was meeting the employment requirement. She was showing effort. But I kept thinking about what Patricia had said. About how real change is messy. This wasn't messy. This was a performance with a very specific audience. Me. Or more accurately, my money. I saved every screenshot, every email, building my own documentation file. If she completed everything and I still refused to release funds, she'd probably take me to court. I needed my own evidence that something wasn't right. She sent me screenshots of applications and interview schedules—proof of effort, or performance?

Image by RM AI

Image by RM AI

Kyle's Silence

Kyle hadn't called in three weeks. Not once. Every phone conversation, every text, every screenshot—it all came from Melissa alone. At first, I thought maybe he was stepping back, giving her space to figure things out herself. That would have been healthy, honestly. But the more I thought about it, the more wrong it felt. Kyle wasn't the type to step back. He was the type to orchestrate. I remembered how he'd coached her during that first conversation about the 'matching funds'—the careful wording, the strategic pauses. He was a consultant. He lived for strategic planning. So why would he suddenly go silent during the most critical phase of their financial recovery? Unless silence was the strategy. Maybe he figured I was watching Melissa's every move, so better to stay invisible. Let her be the face of compliance while he worked behind the scenes. I kept checking my phone, half expecting him to slip up and send a text from her account, or accidentally get on a call. But no. The man was disciplined, I'll give him that. Melissa always called alone now—Kyle's silence felt less like retreat and more like strategy.

Image by RM AI

Image by RM AI

The First Interview

Melissa called me on a Tuesday afternoon, and for the first time in weeks, she sounded nervous. 'Mom, I have an interview tomorrow. Marketing coordinator position. Could we maybe... could you help me prepare?' I felt something crack open in my chest. She needed me. Not my money—me. My experience, my guidance. We spent an hour on the phone going over common interview questions, talking about how to present her freelance work as valuable experience rather than a gap. She laughed when I suggested she mention volunteer work. 'I haven't done that since college,' she admitted. 'Well, maybe start again,' I said gently. 'It shows character.' For those sixty minutes, I forgot about the requirements and the suspicion and Patricia's warnings. I was just a mother helping her daughter. We were connecting. Then, just as we were wrapping up, she asked: 'So if I get this job, how long do I need to stay employed to unlock the money?' The question landed like a slap. She wanted my advice—and for a moment, I felt like her mother again, until she asked how long she'd need to stay employed to 'unlock the money.'

Image by RM AI

Image by RM AI

Helen's Lawyer

David called me at seven in the morning, which meant something was wrong. He's never been an early caller. 'Mom, I need to tell you something, and you're not going to like it.' My stomach dropped. 'Grandma Helen's lawyer called me yesterday. He wanted to know if the family was aware of some unusual inquiries he'd received.' I sat down at my kitchen table. 'What kind of inquiries?' 'Someone asking for copies of Grandma's will, details about her estate structure, information about beneficiaries. He didn't release anything, obviously, but he thought the family should know someone was fishing.' I already knew. I absolutely knew. 'Was it Melissa?' David was quiet for a moment. 'He didn't say directly, but yeah. She apparently told him it was for family planning purposes. That we all wanted to be prepared in case anything happened.' Grandma Helen was eighty-nine and sharp as ever, living independently, managing her own finances. There was no reason for anyone to be requesting her will. No legitimate reason, anyway. Melissa had apparently asked Helen's attorney for copies of her will—'for family planning purposes,' she'd said.

Image by RM AI

Image by RM AI

Richard's Question

Richard scheduled our quarterly portfolio review at his office downtown. We were halfway through discussing asset allocation when he set down his pen and looked at me directly. 'Linda, has Melissa been contacting any of your elderly friends?' The question came out of nowhere. 'What? No. I mean, not that I know of. Why?' He leaned back in his chair, choosing his words carefully. 'I had coffee with Bill Henderson last week—you know Bill, from the investment club. He mentioned his aunt had received a very friendly call from someone claiming to be a financial planning student who wanted to interview successful retirees. She found it odd because this person seemed to know a lot about her already.' My mouth went dry. 'What are you saying?' 'I'm saying Bill's aunt described the caller, and it sounded an awful lot like your daughter. And Bill's aunt happens to be quite well off.' He pulled out a notepad. 'Two other people from our network have mentioned similar calls in the past month.' 'Why would you ask that?' I said, and Richard's expression told me he already knew the answer.

Image by RM AI

Image by RM AI

The Job Offer

The text came through at 4:47 PM: 'Got the job! Marketing coordinator position, full benefits, start date May 3rd!' Three exclamation points. I stared at my phone, trying to summon the appropriate maternal enthusiasm. This was good news. This was what I'd required. She'd actually done it—found employment, gone through interviews, accepted a position. Real progress. I texted back: 'Congratulations, sweetheart! I'm proud of you.' And I was. Sort of. Part of me genuinely felt relieved that she'd shown initiative, that she could still function in a professional environment. Then the second text arrived: 'One requirement down, two to go.' Followed by a little trophy emoji. I set the phone down on my kitchen counter and walked away from it. The phrasing bothered me more than I wanted to admit. Not 'I'm excited to start working again' or 'this feels like a fresh start.' Just a clinical acknowledgment of task completion. Like she was playing a video game and had unlocked the first achievement. I couldn't tell if it was progress or a countdown.

Image by RM AI

Image by RM AI

Coffee with Margaret

I met Margaret at the coffee shop near the hospital where we'd both worked thirty years ago. We used to meet monthly, but life had gotten busy and it had been nearly six months. She hugged me tight and immediately started catching me up on her grandchildren. Then, almost as an afterthought: 'Oh, Melissa reached out to me a few weeks ago! Just to catch up, she said. It was so sweet—I hadn't talked to her since your retirement party.' I froze with my coffee cup halfway to my lips. 'Melissa called you?' 'Yes! We had a lovely conversation. She wanted to know all about retirement, what I was doing with my time.' Margaret smiled. 'She's thinking ahead, I guess. Planning for her own future.' The coffee suddenly tasted bitter. 'Did she ask you anything else?' Margaret's smile faded slightly. 'Well, now that you mention it, she did seem very curious about financial stuff. How much I'd saved, what kind of accounts I had, whether I'd set up trusts. I figured she was just being smart, you know? Learning from people who'd done it right.' Margaret thought it was sweet—until Melissa started asking detailed questions about her retirement accounts.

Image by RM AI

Image by RM AI

The Financial Course

Melissa completed her financial literacy course through a community college program and sent me photos of every assignment. Budgeting worksheets, investment terminology quizzes, retirement planning calculators—she was getting straight A's. 'Look, Mom, I'm really learning this stuff,' she texted with a picture of her portfolio analysis project. I should have been encouraged. This was exactly what I'd hoped for—real education about money management. But as I scrolled through the photos, something felt off. The sections she'd highlighted, the notes in the margins, the extra credit assignments she'd chosen. They were all focused on estate planning. Trust structures. Inheritance tax strategies. Beneficiary designations. Power of attorney documents. How to contest a will. I found myself staring at one particular page where she'd written in careful handwriting: 'Revocable trusts can be changed anytime—vulnerable point.' Vulnerable point for whom? This wasn't a woman learning to manage her own finances. This was someone studying the mechanics of other people's money. She was learning about estate planning, trust structures, and inheritance tax strategies—exactly the wrong lessons.

Image by RM AI

Image by RM AI

The Linkedin Profile

I wasn't snooping. I need you to understand that. I was looking up an old colleague's contact information and happened to search LinkedIn. Melissa's profile appeared in the suggested connections because we were already linked. But her profile had changed dramatically. The headline now read: 'Marketing Professional | Personal Finance Enthusiast | Estate Planning Consultant in Training.' Estate planning consultant? Since when? I clicked through to her profile. She'd added several new skills: 'Retirement Planning,' 'Financial Counseling,' 'Elder Care Advocacy.' Her summary talked about 'helping families navigate complex financial transitions' and 'bridging generational wealth gaps.' It was professionally written, carefully worded, almost believable. Then I looked at her connections. She'd added twenty-three people in the past month. I recognized some of the names—relatives of people from my church, friends of friends, members of my investment club. I clicked on three at random. Dorothy Patterson, age seventy-six. William Chen, age eighty-two. Ruth Kowalski, age seventy-four. She had three connections already—all elderly relatives of people I knew from church.

Image by RM AI

Image by RM AI

Patricia's Research

Patricia showed up at my door three days later with a folder. 'I've been doing some reading,' she said, not quite meeting my eyes as I let her in. We sat at the kitchen table, and she pulled out printed articles, each one highlighted and annotated in her careful handwriting. The first was titled 'Financial Elder Abuse Within Families: Warning Signs.' The second, 'When Adult Children View Parents as Assets.' There were seven more underneath, all from legal journals and elder advocacy websites. She'd highlighted phrases: 'premature claims to inheritance,' 'transactional relationship patterns,' 'cultivation of multiple elderly targets.' My hands started shaking as I read. Every highlighted section described something I'd witnessed. The LinkedIn profile. The sudden interest in my finances. Uncle Frank's confusion. The calculated compliance with my conditions. Patricia watched me read, her expression a mixture of sadness and validation. She understood what she was showing me—what it meant to name the thing you'd been feeling but couldn't quite identify. 'There's a name for this,' Patricia said quietly, sliding the printouts across the table toward me.

Image by RM AI

Image by RM AI

The Three-Month Mark

The text came exactly ninety-one days after Melissa started her job. I know because I'd been watching the calendar myself, wondering if she was counting too. 'Completed three months today,' she wrote. 'Ready to discuss matching funds setup. When can we meet to establish the account?' No greeting. No mention of how the job was going, whether she liked her coworkers, if she'd learned anything interesting. Just the transaction she'd been waiting for. I scrolled back through our messages from the past three months. Every single text was about work verification, hours logged, or the conditions I'd set. Not once had she asked how I was feeling, mentioned the weather, or shared anything personal. I looked at the employment verification documents Richard had collected. She'd worked exactly the minimum required hours each week—never more, never less. She'd taken no vacation days, called in sick only once, and that absence was documented with a doctor's note she'd sent me unprompted. Every requirement met with mathematical precision. 'When can we set up the matching account?' she wrote, and I realized she'd been counting down since day one.

Image by RM AI

Image by RM AI

Uncle Frank's Call

Uncle Frank doesn't call often, so when his name appeared on my phone, I answered immediately. He's eighty-three, lives alone in Phoenix, and usually only reaches out for birthdays or holidays. 'Linda, honey, I need to ask you something,' he started, his voice uncertain. 'I got a call from Melissa a few weeks ago. She said she was taking some financial courses and wondered if I needed help managing my investments. Said she was practicing for a new career in estate planning.' My blood went cold. 'What did you tell her?' I asked, keeping my voice steady. 'Well, I thought it was nice that she was thinking of me,' Frank continued. 'She sent me some forms to fill out, wanted to know about my accounts, my insurance policies. Said it would help her learn how to assist elderly clients.' He paused. 'But Linda, I kept thinking about it, and something felt strange. Why would she need my actual account numbers for practice?' I gripped the phone tighter, my protective instincts roaring to life. Frank had a modest pension and some savings—nothing elaborate, but enough to be comfortable. Enough to be a target. 'She said it was practice for her new career,' Frank explained, 'but something about it felt off.'

Image by RM AI

Image by RM AI

The Matching Funds Setup

Richard asked me to come to the bank in person to set up the matching funds account. I'd expected a simple process—after all, the trust was already established. But when I arrived, he had another banker with him, someone from their fraud prevention department. 'Given the structure you've described,' Richard explained carefully, 'we want to make sure this account has appropriate safeguards.' They set up dual authentication requirements for every withdrawal request. Melissa would need to provide proof of her matching deposit with bank statements showing the source account. I would need to verify and approve each transaction with a secure code sent to my phone. They added a forty-eight-hour waiting period between request and disbursement. 'Is this all really necessary?' I asked, though part of me appreciated the caution. Richard glanced at his colleague, then back at me. 'Mrs. Patterson, in my thirty years of banking, I've seen a lot of family financial arrangements. The structure you're creating...' He trailed off, choosing his words carefully. 'These protections benefit everyone involved.' His tone was professional, but his eyes held something else—concern, maybe even warning. Richard added extra authentication steps I hadn't asked for—'Just in case,' he said, not meeting my eyes.

Image by RM AI

Image by RM AI

Kyle Resurfaces

Melissa asked to meet at a coffee shop downtown, which surprised me. She usually preferred my house—neutral territory, she'd called it once, though I'd thought my own home was anything but neutral. When I arrived, Kyle was there. I hadn't seen him since that awful dinner months ago, and his sudden reappearance set off alarm bells. 'Kyle wanted to be here for this,' Melissa said, as if his presence needed no further explanation. They sat side by side, a unified front, and Kyle placed a folder on the table between us. Inside were tabs, labels, color-coded sections. Employment verification with supervisor signatures and timestamps. Financial literacy course certificates with completion dates and grades. Bank statements showing Melissa's savings account with regular deposits highlighted. A spreadsheet tracking her work hours against my requirements. Every document was pristine, organized, irrefutable. 'We wanted to make sure everything was in order,' Kyle said, and that 'we' hit me like a slap. This wasn't spontaneous. This wasn't Melissa trying to prove herself independently. They'd been working together, strategizing, documenting. He had a folder full of documents—employment verification, financial course completion, bank statements—and I realized they'd been building a case.

Image by RM AI

Image by RM AI

The First Withdrawal Request

The formal withdrawal request arrived via email, CC'd to Richard at the bank. Melissa had deposited two thousand dollars into her savings account over the three-month period—verified by the attached bank statements. According to my matching arrangement, she was entitled to four thousand dollars from the trust. The email was professionally formatted, almost like a business proposal. 'Request for Distribution per Agreement Terms,' the subject line read. She outlined each condition I'd established, checked off each requirement she'd met, and cited the specific matching ratio I'd established. There were no pleasantries, no acknowledgment of our relationship beyond the financial arrangement. I read it three times, looking for some small personal detail—a 'Hope you're well,' or 'Thank you for this opportunity.' Nothing. Just numbers and terms and verification. Richard called an hour later. 'The documentation is in order,' he said carefully. 'Everything meets the requirements you established.' I could hear the unspoken question in his voice: was I really going to do this? Was I going to reward this cold, calculated compliance? But I'd set the terms. I'd created this system. She'd matched two thousand dollars and wanted four—the first test of whether my conditions were real or just threats.

Image by RM AI

Image by RM AI

The Transaction

I called Richard and authorized the transfer. He walked me through the authentication process—the codes, the confirmations, the forty-eight-hour waiting period. 'You're certain about this?' he asked one final time before submitting the transaction. I wasn't certain about anything anymore, but I'd made the rules and she'd followed them. Two days later, I received the notification that four thousand dollars had been transferred from the trust to Melissa's account. I stared at my phone, waiting for something—a call, maybe, or at least a text with some warmth to it. An hour passed. Then two. Finally, as I was making dinner, my phone buzzed. 'Received. Thank you.' That was it. Two words. Not 'Thanks, Mom' or 'I appreciate this' or even 'Got it.' Just a confirmation of receipt, like I was a bank teller or an automated system. I thought about all the times I'd sent her money when she was younger—for college textbooks, car repairs, security deposits. She'd always called then, excited and grateful, telling me what it meant to her. Now I was dispensing her inheritance in installments, and all I got was a transaction confirmation. She texted 'thank you' without a single personal word—just confirmation of the transaction amount.

Image by RM AI

Image by RM AI

David's Discovery

David's call came at seven in the morning, which meant something was wrong. 'Mom, we have a problem with Grandma Helen,' he said, his words tumbling out fast. 'Melissa got herself added to Helen's checking account as a joint holder.' I sat up in bed, my heart pounding. 'What do you mean, added?' I asked. 'How?' David explained that Helen's bank had called him—he was listed as her emergency contact—to verify a change in account ownership. Melissa had apparently visited Helen three weeks ago and helped her 'organize her finances.' She'd driven her to the bank, sat with her while she filled out paperwork, and left with full access to Helen's checking account. 'The bank said Helen signed all the forms,' David continued. 'They have her signature, her ID, everything legally required.' But when David went to check on Helen yesterday, she seemed confused about the whole thing. She remembered Melissa visiting, remembered going to the bank, but couldn't quite recall why they'd gone or what she'd agreed to. 'She thought Melissa was helping her set up online banking,' David said, frustration and fear mixing in his voice. 'Helen can't remember agreeing to it,' David said, his voice shaking, 'but Melissa has the paperwork to prove it.'

Image by RM AI

Image by RM AI

The Family Meeting

We met at Patricia's house—neutral territory where none of us would feel too exposed. David brought a yellow legal pad covered in notes, dates, details. Patricia had made coffee that none of us touched. I'd printed out bank statements, trust documents, everything I'd been collecting. 'Let's start with Helen,' David said, his voice tight. He walked us through the timeline—Melissa's visit three weeks ago, the bank trip, the joint account that Helen couldn't quite remember authorizing. Patricia leaned forward. 'She tried something similar with me,' she admitted. 'Last October. Wanted to help me 'organize my estate' after Gerald died. Said I needed someone younger to understand modern banking.' I felt something cold settle in my stomach. 'She asked me about my investment accounts,' I said slowly. 'About liquidation timelines. About how quickly I could access funds.' David kept writing, his pen scratching across the page. We went through it all—every conversation, every helpful suggestion, every casual question about money and accounts and access. Patricia mentioned Melissa asking about her long-term care insurance. David remembered her inquiring about Helen's bonds, her CDs, her savings strategy. We laid out the timeline—every visit, every question, every new account—and the pattern became impossible to ignore.

Image by RM AI

Image by RM AI

The Second Withdrawal

The email arrived on a Thursday morning with the subject line 'Second Distribution Request.' Melissa had attached receipts, bank statements, and a notarized letter documenting her matching contribution—six thousand dollars deposited into an account she'd opened specifically for this purpose. The proof was meticulous, organized, exactly what the trust required. 'As you can see, I've fulfilled the requirements,' she wrote. 'I'm ready to receive the matching distribution at your earliest convenience.' I stared at the bank statement showing her deposit. Six thousand dollars, transferred in three installments over the past three weeks. The account was new, opened just a month ago. I called David immediately. 'Where would she get six thousand dollars?' I asked. 'She's always complaining about money, about how expensive everything is.' He went quiet. 'I don't know, Mom. But it's weird, right? The timing?' I pulled up my own records, comparing dates. Her deposits had started right after David discovered the joint account situation with Helen. The first deposit came two days later. Then another. Then the final one, completing the six thousand exactly. I couldn't help wondering where a marketing assistant suddenly found six thousand dollars to match.

Image by RM AI

Image by RM AI

Helen's Missing Money

David's second call that week came at night. 'Mom, the bank flagged Helen's account,' he said without preamble. 'There have been withdrawals. Significant ones.' My hands went cold. 'How significant?' 'Six thousand dollars over three weeks. Three separate transfers to an account Helen doesn't recognize.' He sounded exhausted. 'The bank only caught it because their fraud detection system noticed the pattern—new joint account holder, immediate withdrawals, elderly primary account holder.' I already knew before he said it. I pulled up the timeline I'd been keeping, the dates of Melissa's deposits. 'Tell me when the withdrawals happened,' I said. David read off the dates. They matched perfectly—within a day of each of Melissa's deposits. Two thousand, then two thousand, then two thousand. 'Helen didn't authorize any of it,' David continued. 'She has no idea money was even taken. She can see the balance is lower but thought maybe she'd forgotten some bills.' I felt sick. 'David, those dates—' 'I know,' he interrupted. 'I already checked.' Six thousand dollars withdrawn over three weeks—the exact amount Melissa needed to match my trust distribution.

Image by RM AI

Image by RM AI

Confronting Richard

I called Richard from my car, sitting in Patricia's driveway because I couldn't wait until I got home. 'I need you to look into something,' I said. 'Melissa's matching funds for the second withdrawal—I need to know where they came from.' There was a pause. 'Linda, if you're asking me to investigate your daughter—' 'Six thousand dollars taken from her grandmother's account,' I interrupted. 'The same six thousand she used to claim her trust distribution. Same amounts, same dates. Richard, she stole from Helen.' I heard him exhale slowly. 'Do you have documentation?' I did. I had everything—bank statements, transfer records, dates that aligned too perfectly to be coincidence. Richard was quiet for a long moment. 'This is elder financial abuse,' he finally said. 'It's a crime. You understand that?' I understood. 'But here's what concerns me more,' Richard continued, his voice taking on that professional tone he used when discussing complicated cases. 'If she did this with Helen, if she targeted her own grandmother this deliberately... Linda, this suggests planning. Systematic thinking. This isn't opportunistic—it's strategic.' 'I've seen this before,' Richard finally admitted, 'but I've never seen someone do it to their own family.'

Image by RM AI

Image by RM AI

The Facebook Group

Patricia called me three days later, her voice shaking. 'You need to see something,' she said. 'I've been doing some digging online.' She'd been searching for information about financial abuse, trying to understand what we were dealing with, and had stumbled onto something else entirely. 'There are these forums,' Patricia explained when I arrived at her house. 'Groups where people discuss estate planning, inheritance strategies, ways to access family money early.' She pulled up a website on her laptop—a private Facebook group called 'Future Financial Planning.' Hundreds of members, thousands of posts. 'Look at this username,' Patricia said, scrolling to a particular thread. FutureHeir2024. Someone asking detailed questions about trust structures, about how to qualify for early distributions, about working with elderly relatives who might need 'help' managing their finances. The posts went back months—before Christmas, before my retirement announcement, before any of this started. Questions about joint accounts. Questions about matching requirements. Questions about legal loopholes and what documentation would be needed. Her username was 'FutureHeir2024,' and she'd been posting detailed questions about trust loopholes for months.

Image by RM AI

Image by RM AI

The Legal Consultation

The elder law attorney's office smelled like old books and furniture polish. Margaret Chen had handled Gerald's estate for Patricia, and came highly recommended. I laid out everything—the trust, the withdrawals, Helen's stolen money, the online forums. Margaret listened without interrupting, taking occasional notes. 'What I need to know is how to protect the others,' I said. 'My mother is still alive. Patricia. Other relatives who might be vulnerable.' Margaret nodded slowly. 'First, we need to understand what we're dealing with. This pattern you're describing—targeting multiple elderly relatives, systematic financial reconnaissance, using stolen funds to access legitimate distributions—it has a name.' I leaned forward. 'In my practice, we call it inheritance impatience syndrome,' Margaret continued. 'It's when someone who expects to inherit begins treating that inheritance as if they already own it. They view elderly relatives as assets rather than people. They start managing what they see as their future portfolio.' She looked at me over her reading glasses. 'The most concerning cases involve multiple targets—when someone is actively cultivating relationships with several elderly relatives simultaneously, positioning themselves for access.' The attorney asked if I'd heard of 'inheritance impatience syndrome'—and suddenly everything clicked into focus.

Image by RM AI

Image by RM AI

The Research

I spent three days at my computer, reading everything I could find about inheritance abuse and financial exploitation of elderly relatives. The articles were clinical, detached, written by attorneys and social workers and researchers. But they could have been written about Melissa. The patterns were identical—the helpful assistance that led to account access, the gradual isolation from other family members, the strategic cultivation of multiple elderly targets. One article described how abusers often treated elderly relatives as an investment portfolio, calculating potential returns and managing relationships for maximum financial benefit. Another discussed reconnaissance behavior—asking detailed questions about assets, liquidity, and access procedures under the guise of innocent concern. A third detailed how sophisticated abusers would use funds from one target to manipulate another, creating complex chains of exploitation. I made notes, highlighted passages, cross-referenced everything against my own timeline. Helen's joint account. Melissa's questions about my investments. Her offer to help Patricia 'organize' her estate. Her detailed knowledge of the trust structure before I'd even explained it. The articles talked about multiple targets, financial reconnaissance, and systematic exploitation—I was reading my daughter's playbook.

Image by RM AI

Image by RM AI

The Pattern

It hit me on the fourth morning, sitting at my kitchen table surrounded by printouts and timelines and bank statements. This wasn't about my retirement fund. It had never been about my retirement fund. That was just the largest target, the main prize. But Melissa hadn't been waiting for me to die to start collecting. She'd been working the whole family like assets in a portfolio—Grandma Helen with her accessible checking account, Patricia with her widow's settlement, my mother with her Social Security and pension. Each one represented future money, future access, future inheritance. And Melissa had been systematically positioning herself with all of them, asking questions, offering help, gathering information about accounts and assets and access procedures. The trust had just accelerated her timeline for me specifically. But the others? She'd been cultivating those relationships for years, playing the devoted granddaughter, the concerned niece, the helpful relative who just wanted to make things easier. I thought about her username—FutureHeir2024. Not future heir to one estate. Future heir to multiple estates. It wasn't just about my money—it never was. Melissa saw every aging family member as an asset, and she'd been managing her 'portfolio' for years.

Image by RM AI

Image by RM AI

Uncle Frank's Will

Patricia called me on day five with something she'd found while sorting through old family documents. Uncle Frank had updated his will two months before he died. Nothing unusual there—he was ninety-two, probably just tidying affairs. Except Patricia had noticed something. The witness signature was from the same assisted living facility where Melissa had started 'volunteering' last year. She sent me a photo of the will amendment. Melissa wasn't just included—she was listed as a primary beneficiary, receiving a third of his estate alongside Frank's actual children. My hands went cold looking at it. Frank had early dementia. Everyone knew it. He'd repeat stories, forget conversations, sometimes couldn't remember what year it was. And according to the visitor log Patricia obtained from Frank's daughter, Melissa had visited him three times in March, the month before he signed those changes. Not random visits spread over months or years. Three calculated visits in four weeks. She'd waited until his mind was vulnerable, then swooped in with her helpfulness and her charm and her 'investment advice.' Frank was ninety-two and had early dementia—and Melissa had visited him three times in the month before he updated his estate plan.

Image by RM AI

Image by RM AI

The Spreadsheet

Two days later, Patricia arrived at my house with her laptop, her face ashen. 'You need to see this,' she said, setting it on my kitchen table. She'd been helping David go through some of Melissa's old files—things she'd stored on the family shared drive, thinking they were safe. And there it was. A spreadsheet titled 'Family Assets 2023.' My stomach dropped before I even opened it. Rows and rows of names. Uncle Frank. Grandma Helen. My mother. Patricia herself. Aunt Diane. Cousin Robert. Even Richard, though he wasn't blood family. Each name had its own row with meticulous columns. Estimated Net Worth ranged from $40K to $850K. Health Status used coded terms: 'Declining,' 'Stable,' 'Vulnerable.' Relationship Strength was rated one through five stars. And Access Level noted who had power of attorney, who lived alone, who had helpful relatives nearby. I stared at my own row. Net Worth: $425K. Health Status: Good. Relationship Strength: 3 stars. Access Level: Trust established. We weren't family to her. Each name had columns labeled 'Estimated Net Worth,' 'Health Status,' 'Relationship Strength,' and 'Access Level'—we weren't family, we were investments.

Image by RM AI

Image by RM AI

Freezing the Trust

I called Richard before Patricia even left my house. My voice was shaking but steady enough. 'I need you to freeze the trust immediately. All distributions, all access. Everything stops now.' He didn't ask why—he'd known me long enough to hear the urgency. We met at his office two hours later. I brought the spreadsheet, the will changes, Helen's bank statements, everything. Richard spread it across his conference table, reading in silence. When he finally looked up, his expression was grim. 'Linda, this is serious. This goes beyond family disputes. If she pressured Frank to change his will while he had dementia, if she manipulated Helen's account access—these could constitute elder fraud. Financial exploitation. Potentially undue influence.' I nodded. I knew. 'We have grounds to freeze the trust pending investigation,' he continued carefully. 'But Linda, you understand what comes next? If we pursue this formally, if we bring in authorities, this won't stay private. It could mean criminal charges.' My throat tightened. My daughter. Criminal charges. But the faces in that spreadsheet—vulnerable, trusting people who'd been reduced to dollar signs. Richard said we had grounds for fraud—but proving it would require exposing my daughter to potential criminal charges.

Image by RM AI

Image by RM AI

Melissa's Rage

Melissa showed up at my door three days after the freeze. No call, no warning. Just pounding on my front door at seven in the evening. When I opened it, her face was red with fury. 'What did you do?' she demanded, pushing past me into the hallway. 'The trust is frozen. Richard won't return my calls. What the hell did you do?' I closed the door slowly, keeping my voice level. 'I protected what needed protecting.' 'From what? From me? I'm your daughter!' She was shouting now, all composure gone. 'I followed every rule of that ridiculous trust. I did everything you asked. And now you're punishing me for actually succeeding?' I walked to the kitchen, retrieving the printed spreadsheet from the counter. Set it down between us. 'Where did your matching funds come from, Melissa?' Her eyes flicked to the paper, then back to my face. 'That's none of your—' 'Grandma Helen's account. Uncle Frank's estate. Where did the money come from?' Her mouth opened. Closed. The fury in her eyes shifted to something else—calculation, maybe panic. 'You can't do this!' she screamed, but when I asked where her matching funds came from, she went silent.

Image by RM AI

Image by RM AI

Helen's Testimony

David brought Helen to my house the next morning. She looked smaller than I remembered, frail in a way that broke my heart. She wouldn't meet my eyes when she came in. 'Helen,' I said gently, guiding her to the couch. 'I need you to tell me what happened with your bank account. With Melissa.' Her hands twisted in her lap. David sat beside her, his hand on her shoulder. 'It's okay, Grandma. Just tell her the truth.' Helen's voice came out thin and shaky. 'She was so helpful, Linda. She offered to help me with my bills, with organizing my accounts. Said it would be easier if she had access, just in case I needed help. And I thought—well, family helps family, right?' Tears started sliding down her cheeks. 'But then she started asking questions. About how much I had, about my will, about who I was leaving things to. And I felt—I felt like I couldn't say no. Like I owed her something for being so kind.' My chest ached. 'Did she pressure you to add her to the account?' Helen nodded, miserable. 'She said it would make things easier when I'm gone,' Helen whispered, 'and I was too embarrassed to say no.'

Image by RM AI

Image by RM AI

Kyle's Role

I found Kyle at their apartment two days later. Melissa wasn't home—probably avoiding me. But Kyle answered the door like he'd been expecting me. 'Linda,' he said flatly. No pretense of warmth. 'I know why you're here.' We sat in their pristine living room, the one they'd furnished with money that should've still been in trust. 'Did you know?' I asked directly. 'About the other relatives? The spreadsheet? Uncle Frank?' He didn't flinch. 'We're married. Of course I knew.' The casualness of it hit me like a slap. 'So you helped her? Planned this together?' Kyle leaned back, completely unbothered. 'Melissa's good at reading people, at building relationships. I'm good at strategy, at planning. We make a good team.' His voice was cold, businesslike. 'These people were going to leave their money to someone eventually. Why not to family who actually paid attention to them?' I stared at him, this man I'd welcomed into our family. 'You targeted vulnerable elderly people.' He shrugged. 'We were kind to lonely old people. That's not a crime, Linda. 'It's not illegal to be nice to old people,' Kyle said coldly, 'and it's not our fault if they want to share their wealth.'

Image by RM AI

Image by RM AI

The Family Meeting

I called the family meeting for Saturday morning at Patricia's house. Neutral ground, big enough for everyone. I'd reached out individually to everyone I could think of, everyone whose name had appeared in that spreadsheet. Some knew why they were coming. Others just knew I'd asked them to show up. The living room filled up—David and Helen, Patricia, Aunt Diane, Cousin Robert, Uncle Frank's daughter Sarah, Richard for legal counsel. Others too. People I hadn't even known Melissa had contacted. Each one brought their story. Helen's bank account. Frank's will. Diane's 'borrowed' jewelry that was never returned. Robert's investment tips that cost him thousands. Patricia's casual questions about her late husband's life insurance. Sarah's discovery that Melissa had asked Frank to lend her money a week before he died. The pattern was everywhere once you knew to look for it. Helpful conversations that gathered information. Kindness that came with questions about assets, wills, accounts. Relationships that intensified when health declined. I counted heads as people shared their experiences, my heart sinking with each new story. Nine relatives came forward—nine people Melissa had targeted, cultivated, and positioned herself to inherit from.

Image by RM AI

Image by RM AI

The Choice

Richard stayed after everyone else left. We sat in Patricia's kitchen, just the two of us, while he laid out my options in his careful lawyer voice. 'We have documented evidence of financial exploitation. Multiple victims. A clear pattern. The DA would likely prosecute if we brought this forward.' He paused. 'Or you can handle this privately. Require full restitution, supervised probation within the family, professional counseling. It wouldn't be easy, but it would avoid criminal records.' Criminal records. For my daughter. I thought about Melissa as a child, the little girl who used to hold my hand in parking lots. Then I thought about Helen's face, about Frank's confusion, about nine elderly people reduced to rows in a spreadsheet. Richard was watching me carefully. 'Linda, I know this is impossible. She's your daughter.' She was. But she'd also systematically exploited vulnerable people who trusted her. People who loved her. The law said I could press charges, bring in investigators, let the system handle it. But I was still her mother. And some part of me—despite everything—still hoped she could face what she'd done and choose differently. I could destroy her legally—or give her the opportunity to return what she'd taken and face what she'd become.

Image by RM AI

Image by RM AI

The Ultimatum

I met Melissa at a coffee shop the next morning, Richard's legal documentation in my bag. She looked tired, or maybe just annoyed that I'd insisted on this meeting. I slid the papers across the table. 'You have two choices,' I said. 'Return every penny you took from family members—all of it, with Richard overseeing the transfers. Attend counseling, real counseling, for as long as it takes. Or I take everything we've documented to the district attorney's office, and you face criminal charges for financial exploitation of the elderly.' She didn't even look at the papers. Just stared at me with this blank expression. 'You're actually serious.' 'Completely serious.' I kept my voice steady. 'You exploited vulnerable people who loved you. You manipulated Helen while she was grieving. You're not taking another dollar from anyone in this family.' Something shifted in her face then. The mask she'd been wearing—the wounded daughter act, the justifications—it all dropped away. What was left was cold and ugly and so foreign I barely recognized her. She leaned forward, and her voice was perfectly calm. 'You know what the real problem is? You were supposed to die first.' The words hung there between us, and I finally understood. She hadn't been waiting for an inheritance. She'd been waiting for me to be gone.

Image by RM AI

Image by RM AI

The Restitution

Melissa chose restitution over prosecution. I'm not sure if it was genuine remorse or just fear of a criminal record, and honestly, I stopped caring which. Richard handled the logistics, setting up a payment schedule and monitoring every transfer. Helen got her money back first—the full amount Melissa had taken, plus interest Richard calculated. Then Frank. Then the others, one by one. I watched Melissa write the checks, watched her log into banking apps and authorize transfers. Her face was blank the entire time, like she was paying utility bills. No apology. No acknowledgment of what she'd actually done to these people. Just mechanical compliance with the terms Richard had laid out. When she handed Helen's restitution check to Richard, I waited for something—some flicker of recognition that this was her aunt, someone who'd loved her since birth. Nothing. 'Is that it for today?' she asked, checking her phone. That's when it hit me. The restitution wasn't justice. It was just moving money back to where it belonged. But Melissa herself—the person who'd done this, who'd justified it, who'd looked at vulnerable elderly family members and seen opportunities—she hadn't changed at all. She made the payments mechanically, without apology—and I realized she still didn't understand what she'd done wrong.

Image by RM AI

Image by RM AI

Protecting the Family

While Melissa made restitution payments, I focused on making sure this could never happen again. Richard helped me set up meetings with every family member over sixty. We arranged protective trusts, established financial oversight systems, and set up mandatory second-signature requirements for large transactions. David attended every meeting, taking notes and asking practical questions. He'd become my partner in this, determined to protect the family his sister had targeted. We educated people about financial manipulation tactics. Helen learned to recognize the warning signs. Frank's daughter got power of attorney. Patricia set up alerts on her accounts. Some of them were angry—at Melissa, at themselves for not seeing it sooner. Others were just sad. But they all participated, all took steps to protect themselves. Richard drafted documents, explained legal protections, and patiently answered the same questions multiple times. 'You're building a fortress,' he said one afternoon, reviewing our progress. 'That's exactly what I'm doing,' I replied. Because Melissa had returned the money, but she'd never actually admitted she'd done anything wrong. Never shown genuine remorse. Never demonstrated any understanding of the harm she'd caused. We couldn't stop Melissa from trying again with someone else—but we could make sure our family would never be her victims again.

Image by RM AI

Image by RM AI

Building Your Own

People keep asking if I regret how I spent my retirement money. The trips, the experiences, the life I built instead of the inheritance I was 'supposed' to preserve. And you know what? I don't regret a single dollar. Because here's what I finally understood: I didn't spend Melissa's inheritance. That money was never hers. It was mine—earned through decades of work, of choices, of building a life. What I actually gave Melissa was something much more valuable, though she'll probably never recognize it. I gave her the opportunity to build her own life instead of waiting for mine to end. The chance to find purpose beyond measuring her worth against someone else's bank balance. To discover who she could become when she wasn't suspended in this holding pattern, waiting for other people to die so she could finally live. She rejected that gift. Chose resentment over growth. Exploitation over effort. And that's on her, not me. I can't fix what's broken in my daughter. Can't make her see that the greatest inheritance isn't money—it's knowing you earned everything you have, that you built something real with your own hands. That lesson cost me a daughter, but maybe it will save someone else's mother.

Image by RM AI

Image by RM AI

KEEP ON READING

The 20 Most Recognized Historical Figures Of All Time

The Biggest Names In History. Although the Earth has been…

By Cathy Liu Oct 4, 2024

10 of the Shortest Wars in History & 10 of…

Wars: Longest and Shortest. Throughout history, wars have varied dramatically…

By Emilie Richardson-Dupuis Oct 7, 2024

10 Fascinating Facts About Ancient Greece You Can Appreciate &…

Once Upon A Time Lived Some Ancient Weirdos.... Greece is…

By Megan Wickens Oct 7, 2024

20 Lesser-Known Facts About Christopher Columbus You Don't Learn In…

In 1492, He Sailed The Ocean Blue. Christopher Columbus is…

By Emilie Richardson-Dupuis Oct 9, 2024

20 Historical Landmarks That Have The Craziest Conspiracy Theories

Unsolved Mysteries Of Ancient Places . When there's not enough evidence…

By Megan Wickens Oct 9, 2024

The 20 Craziest Inventions & Discoveries Made During Ancient Times

Crazy Ancient Inventions . While we're busy making big advancements in…

By Cathy Liu Oct 9, 2024