Old-Money: The Hidden Dynasties That Shaped the Course of History

When we think about the forces that shaped modern civilization, we usually point to revolutions, wars, and political movements. We spend less time thinking about the families who financed them. Behind nearly every major historical turning point stands a dynasty that made it possible through carefully deployed capital, strategic marriages, and influence accumulated over generations. The Medicis funded the Renaissance. The Rothschilds financed wars and governments across Europe. The Rockefellers built industrial America while the Morgans held it together during financial collapse. These families did not just accumulate wealth; they wielded it to remake entire societies.

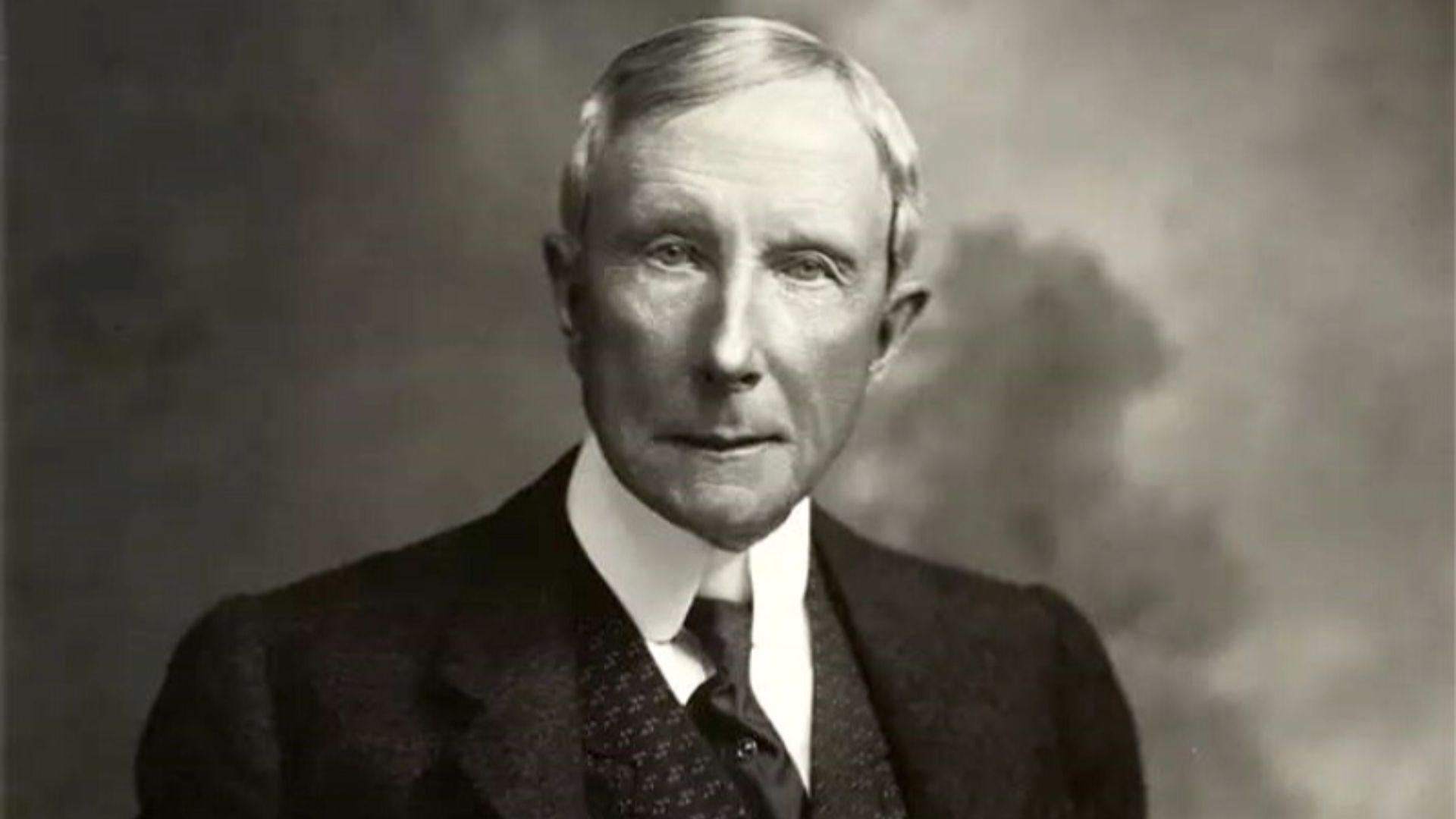

The difference between old money and new money extends far beyond how many generations have held the fortune. Old-money dynasties understood something that lottery winners and tech billionaires often miss: wealth compounds most effectively when invested in institutions, relationships, and power structures that outlast individual lifetimes. According to Bloomberg, the world's 25 richest families currently control more than $2.9 trillion in wealth. Yet even this staggering figure pales beside the influence these families exercised when their power peaked. At their height in the 19th century, the Rothschilds were the richest family in the world. The Medici Bank was the largest in 15th-century Europe. John D. Rockefeller became America's first billionaire in 1916, with an estimated net worth of $1.4 billion at his death in 1937, equivalent to $21.7 billion in 2024, though some financial scholars suggest his wealth may have reached $400 billion in today's money.

The Banking Dynasties That Built Modern Finance

The Medici family demonstrated how banking could become the foundation for political dominance long before the Rothschilds or Morgans appeared. Giovanni di Bicci de Medici established the Medici Bank in Florence in 1397, and his son Cosimo the Elder expanded the family business by opening branches in Geneva, Venice, and Rome. The bank managed papal finances, giving the Medicis enormous leverage over the Vatican. By 1434, Cosimo had become the unofficial head of the Florentine Republic despite officially remaining a private citizen. Pope Pius II observed that Cosimo was "king in everything but name".

The Medicis pioneered financial innovations still used today. They popularized double-entry bookkeeping, which allowed merchants and bankers to track assets and liabilities with unprecedented accuracy. They developed letters of credit that enabled international trade to flourish across Europe. The family also perfected the holding company structure, running numerous banking branches as partnerships under a central organization. These technical advances mattered less than what the Medicis did with their capital. They spent lavishly on art, architecture, and scholarship, funding Botticelli, Leonardo da Vinci, Michelangelo, and the construction of Florence's famous dome. Their patronage created the cultural environment that sparked the Italian Renaissance.

The European Network That Financed Governments and Wars

Mayer Amschel Rothschild was born in Frankfurt's Jewish ghetto in 1744 and became Europe's leading banker through a strategy his descendants followed for generations.

He distributed his five sons across Europe's financial centers, establishing branches in London, Paris, Vienna, Naples, and Frankfurt. This geographical dispersion created a communications and capital transfer network faster than any government could match. The Rothschilds developed what contemporaries called "absolute discretion," maintaining strict privacy about their business dealings and client relationships.

Nathan Rothschild, who established the English branch, secured one of the family's most profitable ventures by lending the British government the money it needed to finance Wellington's campaign against Napoleon. The Rothschilds' ability to move money across borders during wartime made them indispensable to European governments. For much of the 19th century, the Rothschild family was the richest in the world. Their wealth funded everything from splendid estates to major infrastructure projects. In the 1870s, they loaned money to the French government to pay war indemnities. In 1875, Lionel Rothschild in London provided the British government £4 million on a few hours notice, enabling Britain to become the principal stockholder in the Suez Canal Company.

The family adhered to strict principles established by Mayer Amschel Rothschild before his death in 1812. He drew up a partnership agreement and will that laid out guidelines for the family enterprise. The business was to be exclusively for direct male descendants, excluding sons-in-law from ownership and management.

He warned his children against disturbing the business peace, seeking continuity and stability above rapid expansion.

The American Consolidators Who Created Corporate Giants

The Morgan banking dynasty operated differently than the Rothschilds. With a smaller family size, they opened their partnerships to outside talent rather than keeping everything within bloodlines. Junius Spencer Morgan moved to London to capitalize on the city's status as the financial center of the world, partnering with George Peabody before taking over the firm. His son, John Pierpont Morgan, became the dominant figure in American capitalism. J.P. Morgan spearheaded the formation of U.S. Steel, International Harvester, and General Electric. He held controlling interests in Aetna, Western Union, the Pullman Car Company, and 21 railroads.

Morgan twice used his personal fortune to stabilize the American economy. During the Panic of 1907, he held a meeting of the country's top financiers at his New York City home and convinced them to bail out various faltering financial institutions. He headed a group of bankers who took in large government deposits and decided how the money should be deployed for financial relief, thereby preserving the solvency of major banks and corporations.

The Rockefeller dynasty took a different path to power. John D. Rockefeller and his brother William founded Standard Oil in 1870.

By the 1880s, they were among the richest people in the United States. The company's dominance of the oil industry gave the Rockefellers enormous influence over American foreign policy and economic development. John D. Rockefeller became one of the fathers of modern philanthropy, donating the bulk of his wealth to charitable causes.

These dynasties understood that true power comes not from hoarding wealth but from deploying it strategically across generations. They did not just accumulate money; they built the financial architecture of modern capitalism, funded the institutions that define high culture, and shaped government responses to economic crises. We remember kings and presidents, generals and revolutionaries. Perhaps we should pay closer attention to the families who financed them all.

KEEP ON READING

The 20 Most Recognized Historical Figures Of All Time

The Biggest Names In History. Although the Earth has been…

By Cathy Liu Oct 4, 2024

10 of the Shortest Wars in History & 10 of…

Wars: Longest and Shortest. Throughout history, wars have varied dramatically…

By Emilie Richardson-Dupuis Oct 7, 2024

10 Fascinating Facts About Ancient Greece You Can Appreciate &…

Once Upon A Time Lived Some Ancient Weirdos.... Greece is…

By Megan Wickens Oct 7, 2024

20 Lesser-Known Facts About Christopher Columbus You Don't Learn In…

In 1492, He Sailed The Ocean Blue. Christopher Columbus is…

By Emilie Richardson-Dupuis Oct 9, 2024

20 Historical Landmarks That Have The Craziest Conspiracy Theories

Unsolved Mysteries Of Ancient Places . When there's not enough evidence…

By Megan Wickens Oct 9, 2024

The 20 Craziest Inventions & Discoveries Made During Ancient Times

Crazy Ancient Inventions . While we're busy making big advancements in…

By Cathy Liu Oct 9, 2024