Most people know Wall Street as the center of markets and major financial decisions, but the story behind its rise is far more layered than a cluster of tall buildings in Lower Manhattan. It started with geography, grew through ambition, and turned into a global force shaped by centuries of risk-taking and reinvention.

Once you see how those pieces fit together, the modern version of Wall Street suddenly looks less mysterious. Let's dive in.

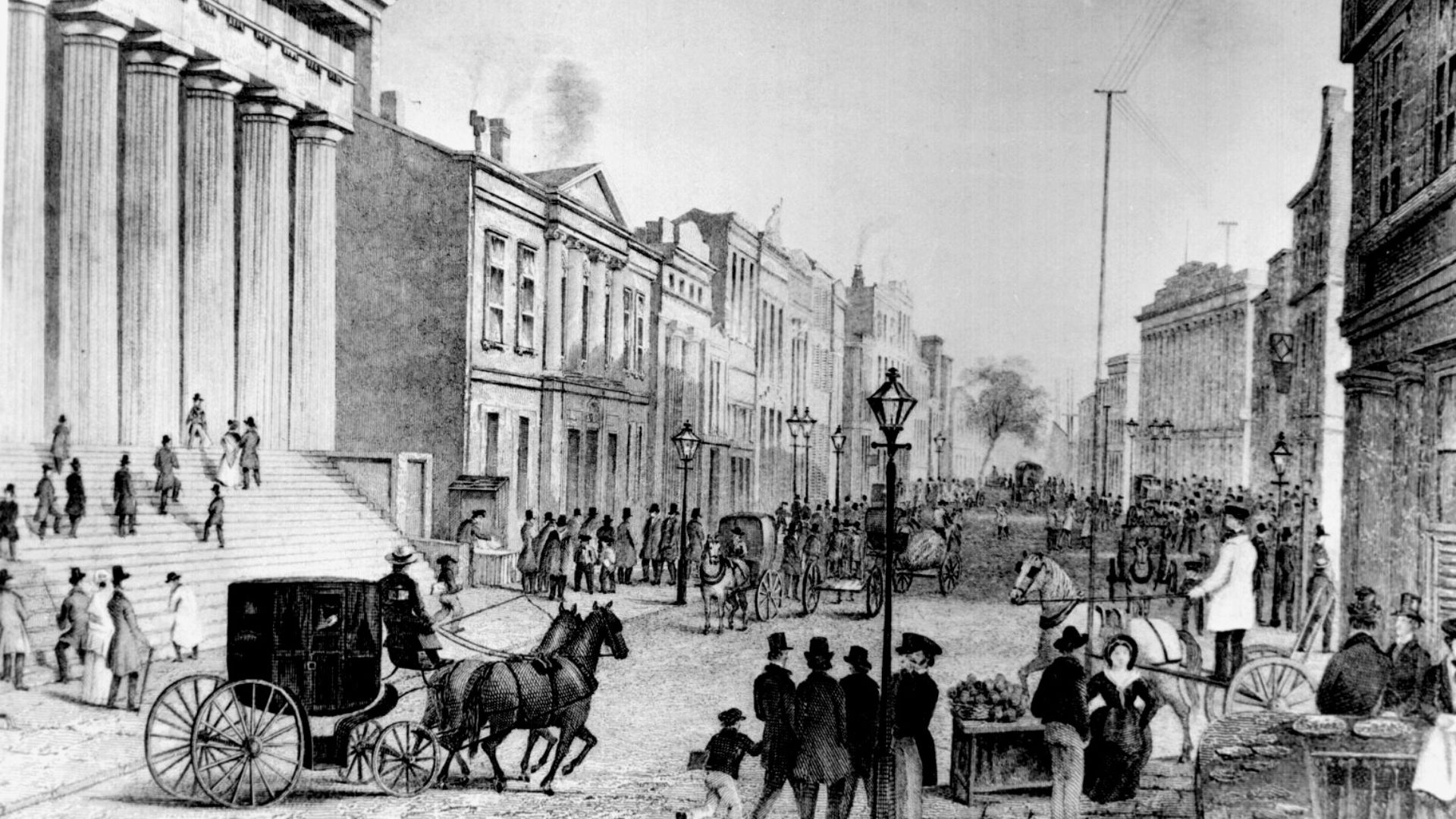

A Busy Trading Spot Turns Into A Financial Center

Wall Street’s origin goes back to the 1600s when the Dutch built a wooden wall to protect the settlement of New Amsterdam. The wall didn’t last, but the name stuck. More importantly, the spot naturally became a place where merchants gathered and exchanged information. Ships arrived with supplies, and a small community began handling deals that stretched far beyond the coastline.

As New York developed into a key port in the 1700s, traders and brokers gravitated toward one another along Wall Street. When the United States was still finding its financial footing after independence, Wall Street became a natural meeting point for anyone looking to buy or sell government bonds or invest in new ventures.

The Buttonwood Agreement And The Birth Of A Market

The turning point came in 1792 when a group of brokers signed the Buttonwood Agreement under a sycamore tree on Wall Street. They agreed to trade only with one another and to set standard commission rates. It sounds simple today, but that small act of coordination created structure and laid the groundwork for what eventually became the New York Stock Exchange.

By the mid-1800s, the country’s rapid industrial growth sent enormous amounts of capital flowing through Wall Street. Railroads, steel companies, banks, and insurance firms needed financing. Investors wanted in. Brokers needed space to handle growing demand, and the street’s identity shifted from a local trading spot to the center of national finance.

A Reputation That Stuck

With size came influence, and with influence came volatility. Wall Street experienced dramatic highs in the early 1900s, followed by historic lows, including the crash of 1929 that triggered the Great Depression. After the crash, the government introduced new regulations to stabilize markets and restore trust. The Securities and Exchange Commission was born to enforce rules and ensure transparency.

These changes strengthened Wall Street’s long-term role by giving investors confidence that the system had protections. As the economy recovered, Wall Street grew again. By the mid-twentieth century, New York’s financial district was handling global transactions and becoming the decision-making center for multinational corporations. The world saw Wall Street not only as a financial engine but also as a symbol of American economic power.

Today’s Wall Street is a collection of institutions that help companies raise money, guide retirement investments, manage economic risk, and support the financial systems people rely on every day. And that’s how a small wooden wall turned into the center of global finance.

KEEP ON READING

20 Common Misconceptions People Have About The Middle Ages

It’s Not All Knights and Shining Armor. Many people romanticize…

By Farva Ivkovic Nov 4, 2024

20 Powerful Ancient Egyptian Gods That Were Worshipped

Unique Religious Figures in Ancient Egypt. While most people are…

By Cathy Liu Nov 27, 2024

The 10 Scariest Dinosaurs From The Mesozoic Era & The…

The Largest Creatures To Roam The Earth. It can be…

By Cathy Liu Nov 28, 2024

The 20 Most Stunning Ancient Greek Landmarks

Ancient Greek Sites To Witness With Your Own Eyes. For…

By Cathy Liu Dec 2, 2024

10 Historical Villains Who Weren't THAT Bad

Sometimes people end up getting a worse reputation than they…

By Robbie Woods Dec 3, 2024

One Tiny Mistake Exposed A $3 Billion Heist

While still in college, Jimmy Zhong discovered a loophole that…

By Robbie Woods Dec 3, 2024