Deception as a Career

Some people hustle hard. Others hustle history. These masterminds didn’t just break the rules—they rewrote them with flair, flash, and forged documents. Behind the world’s wildest scams are stories so outrageous they sound like fiction, but the fallout was all too real. Let’s take a front-row seat to the boldest tricksters.

Abagnale & Associates (Work for Hire) on Wikimedia

Abagnale & Associates (Work for Hire) on Wikimedia

1. WorldCom’s $11 Billion Accounting Fraud

CEO Bernard Ebbers turned a tiny Mississippi phone company into America's second-biggest long-distance provider. WorldCom labeled $3.8 billion in everyday expenses as equipment purchases to fake higher profits. When investigators caught on in 2002, it became America's biggest bankruptcy ever.

U.S. National Communications System on Wikimedia

U.S. National Communications System on Wikimedia

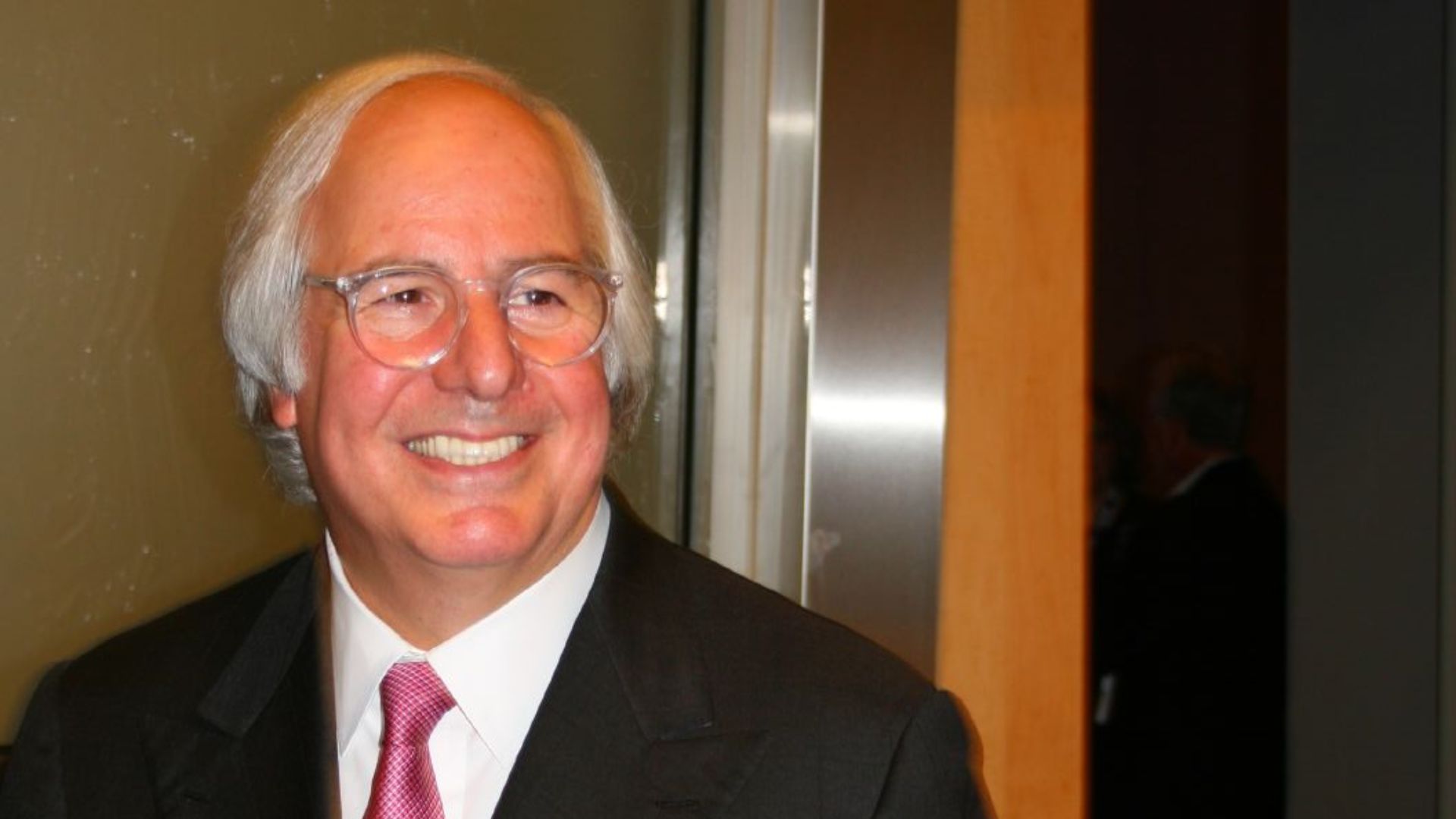

2. Frank Abagnale’s Identity Hoaxes

Frank Abagnale didn’t just forge checks—he assumed false identities. Airlines, hospitals, and law offices all believed he was a professional. Pan Am gave him wings; a hospital let him assist. His legal charade in Louisiana claimed he led lawyers. All the while, the world didn't know a teenager ran the show.

3. Eiffel Tower Sold—Twice

The smooth-talking Czech convinced six scrap metal dealers that Paris secretly wanted to sell the Eiffel Tower. The reason? He claimed maintenance costs were too high. He even pocketed a huge amount of money from Andre Poisson, who thought he'd won the bidding. The crazy part is that Lustig came back a month later and pulled the same trick again with new victims.

4. Enron’s $74 Billion Cover-Up

Fake companies hid $74 billion in debt while top executives sold $1.1 billion in company stock before everything crashed. The scandal resulted in thousands of lost jobs and the destruction of hundreds of millions in worker retirement savings. CEO Jeffrey Skilling also received a 24-year prison sentence, and Congress was compelled to create the Sarbanes-Oxley Act with stricter financial reporting rules.

Jeff Skilling released from federal custody by KHOU 11

Jeff Skilling released from federal custody by KHOU 11

5. Fake Heiress Anna Sorokin

Sorokin convinced some of Manhattan's wealthiest that she had a $70 million trust fund waiting in Germany. She lived in luxury hotels as a German Heiress for months without paying bills—banks gave her $100,000 in loans. She even tried to get $22 million for a private arts club. In fact, the fake heiress act worked for nearly four years before the police caught up with her.

'I deserve a second chance': Anna Sorokin says she has regrets by CNN

'I deserve a second chance': Anna Sorokin says she has regrets by CNN

6. Ponzi’s Postal Coupon Scheme

Ponzi’s scheme relied on exploiting currency gaps via international postal coupons. In theory, it worked: buy low, sell high. But in practice, the system couldn’t support the scale he pretended to manage. He raised $15 million in 1920 alone, and unfortunately, with only 27,000 coupons in existence, his strategy was pure fiction.

Boston Library (NYT); en.wikipedia.org on Wikimedia

Boston Library (NYT); en.wikipedia.org on Wikimedia

7. HealthSouth’s $2.7 Billion Fraud

The rehab hospital chain faked $2.7 billion in profits over seven years to impress Wall Street analysts. Eventually, five financial executives pleaded guilty to false financial records. Although CEO Richard Scrushy was acquitted of the main charges, he was later convicted on separate bribery counts and became the first boss to be charged under the new post-Enron laws.

Richard Scrushy claims wrongful conviction, plans to prove his innocence by WVTM 13 News

Richard Scrushy claims wrongful conviction, plans to prove his innocence by WVTM 13 News

8. Fyre Festival’s Luxury Lie

McFarland promised a "life-changing" music festival in the Bahamas using models like Kendall Jenner, and tickets cost up to $100,000 for VIP packages. However, guests found disaster relief tents instead of luxury villas, and cheese sandwiches replaced gourmet meals. McFarland stole $26 million from investors and received a six-year prison sentence.

Ian Moran (I to Z Photo + Video) on Wikimedia

Ian Moran (I to Z Photo + Video) on Wikimedia

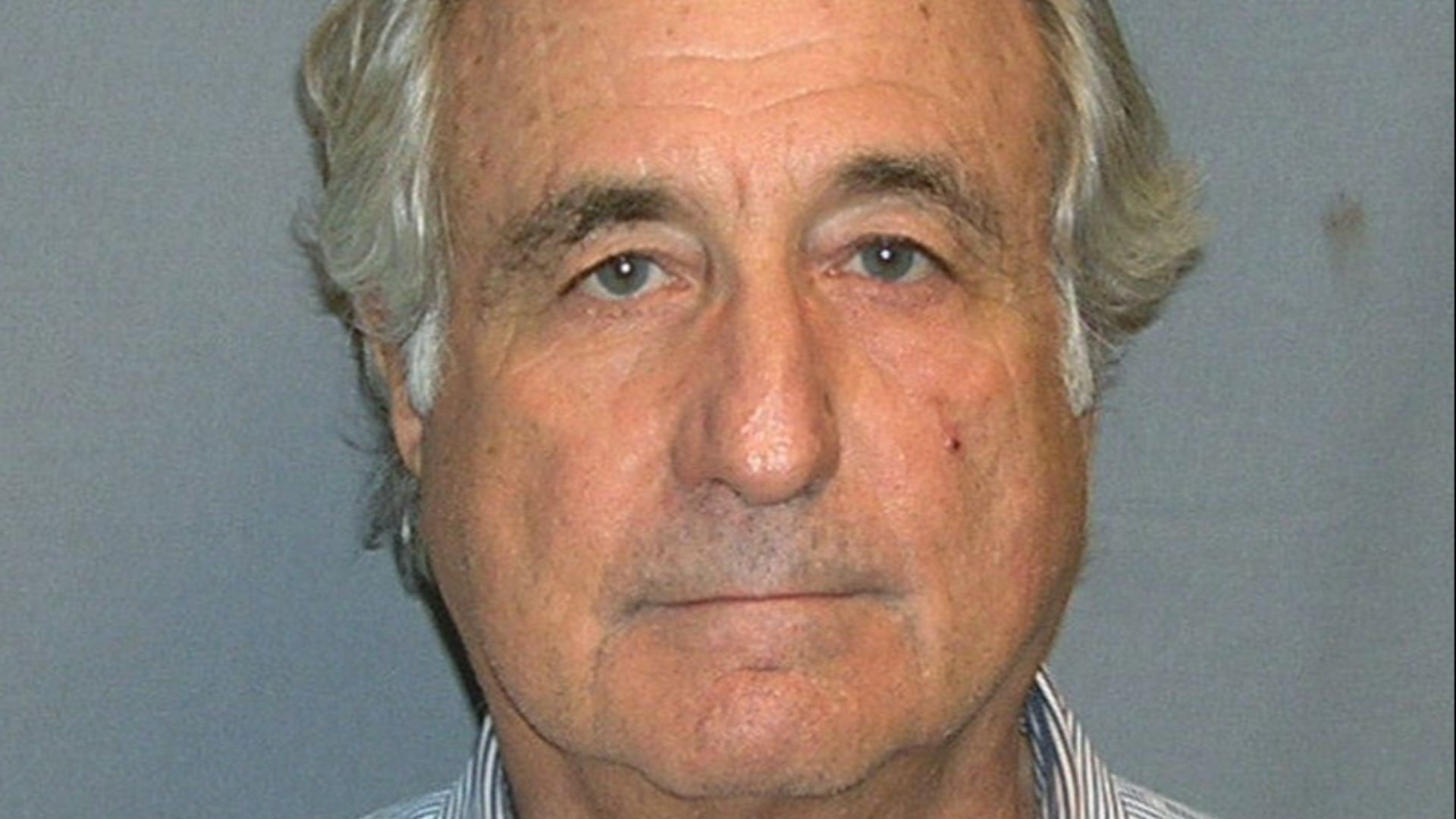

9. Madoff’s $65 Billion Scam

He never actually traded—Madoff just created fake gains and used newcomers’ cash to pay longtime clients. Eventually, the 2008 financial crisis exposed the flaws when many people demanded their money back. He confessed to his own sons, who turned him in, and Madoff got 150 years in prison and passed away behind bars.

U.S. Department of Justice on Wikimedia

U.S. Department of Justice on Wikimedia

10. Luckin Coffee’s Fake Sales

The Chinese coffee chain created fake sales worth 2.2 billion yuan in 2019 to compete with Starbucks. However, it was the employees who purchased orders and falsified customer traffic records. The stock price crashed 80% when the truth came out, erasing over $4 billion in value. CEO Jenny Qian and COO Jian Liu were also fired immediately.

11. Tyco Execs Loot Company Funds

CEO Dennis Kozlowski and finance chief Mark Swartz stole $134 million through fake bonuses and personal loans. They also hid another $430 million from shareholders. Kozlowski even threw a $2 million birthday party in Italy with an ice sculpture that poured vodka. Finally, when caught, both executives received sentences ranging from 8 to 25 years in prison.

12. Jordan Belfort’s Stock Scam

Belfort's Stratton Oakmont hired over 1,000 brokers to push worthless penny stocks on unsuspecting clients. They'd buy cheap stocks, hype them hard, and then sell at peak prices. The firm handled stock issues worth over $1 billion, including Steve Madden's IPO. Belfort later got four years in prison and inspired The Wolf of Wall Street.

13. Adelphia’s Billion-Dollar Family Theft

The Rigas family turned their small Pennsylvania cable company into America's fifth-largest cable provider. But then, founder John Rigas and his sons secretly borrowed $2.3 billion from company funds for personal use. They bought luxury condos, golf courses, and the Buffalo Sabres hockey team. John finally got 15 years in prison at age 80.

John Rigas Returns (2016) by WGRZ-TV

John Rigas Returns (2016) by WGRZ-TV

14. Theranos Blood Test Hoax

Holmes claimed that through her Edison machines, you could run hundreds of blood tests from a single drop. She raised $945 million from investors, including Walgreens and Safeway. But in reality, the machines barely functioned and produced dangerously inaccurate results. Patients even got false cancer scares and HIV diagnoses.

15. Stanford’s $7 Billion CD Fraud

Sentenced to 110 years, Allen Stanford built his fortune on lies. His $7 billion Ponzi scheme sold fake “safe” CDs through a Caribbean bank, and over 18,000 investors bought in. Their funds fueled his lavish lifestyle—private planes, luxury estates, and even international cricket sponsorships. But there were no real returns, only deception.

16. Wirecard’s $2 Billion Disappearance

Germany's major payment processor claimed $2.1 billion in cash that never existed. Braun created fake transactions to boost revenues, and when auditors couldn't find the missing money, Wirecard collapsed instantly. After the whole thing blew up, Braun eventually faced fraud charges.

17. Peregrine’s Forged Bank Records

Wasendorf built his Iowa-based commodities firm over 20 years while secretly stealing $215 million in customer funds. He forged bank statements and even created fake documents to hide the theft. The scheme unraveled when regulators demanded proof of customer deposits, leading Wasendorf to attempt taking his own life before confessing. He then got 50 years in prison.

Unknown authorUnknown author on Wikimedia

Unknown authorUnknown author on Wikimedia

18. Refco’s Hidden Loan Fraud

Phillip Bennett was the brains behind Refco’s rise—and its downfall. The firm dazzled Wall Street and even pulled off a slick IPO, but what investors didn’t know was that Bennett buried an $800 million hole in the books, mostly tied to a shady $430 million loan. The cover-up didn’t last. When it surfaced, so did the handcuffs.

Refco: The $430 Million Lie That Shook Wall Street by STAG RESEARCH

Refco: The $430 Million Lie That Shook Wall Street by STAG RESEARCH

19. OneCoin’s Vanishing Cryptoqueen

Oxford-educated Ignatova convinced investors worldwide that OneCoin was the next Bitcoin, raising $4 billion from 3.5 million victims. However, unlike real cryptocurrencies, OneCoin existed only on paper with no blockchain technology. She vanished in 2017 and is still on the FBI's Most Wanted list, with a $5 million reward for information.

OneCoin Coporation on Wikimedia

OneCoin Coporation on Wikimedia

20. MMM’s Russian Pyramid Collapse

It started with promises of easy money—20% returns or more. By 1997, Sergei Mavrodi's MMM scheme had swallowed $1.5 billion from 15 million people. After the collapse, many were also left broke. Shockingly, this didn't stop Mavrodi as he took the scheme global, repeating history.

KEEP ON READING

Man on the Moon: 20 Most Important Space Missions in…

Lightyears Ahead. Space might still feel like an unknown void,…

By Christy Chan Jan 14, 2026

20 Reasons Why Harry S. Truman Is The Most Notable…

A President Who Shaped the Modern World . Harry S. Truman…

By Rob Shapiro Jan 14, 2026

10 Women History Wants You To Forget & 10 They…

The Stories We Choose to Tell. History is as much…

By Sara Springsteen Jan 14, 2026

10 Assassination Attempts That Failed & 10 That Succeeded

When History Changes Overnight. Assassination attempts can feel like single…

By Elizabeth Graham Jan 14, 2026

AI-Generated History Videos Are More Dangerous Than You Think

When AI Rewrites the Past. What if your favorite history…

By Chase Wexler Dec 30, 2025

Love Him Or Hate Him, Wyatt Earp Was A Legendary…

Legends That Never Fade. Wyatt Earp is one of those…

By Chase Wexler Dec 24, 2025