Decisions That Broke The Bank

Ever made a mistake so bad it cost you lunch money for a week? Now, picture a blunder that wiped out national wealth, dismantled empires, or crashed entire industries. These aren’t typos or missed deadlines—they’re real decisions made by the people in charge. Some were avoidable, and some were ridiculous in hindsight, but all of them were expensive. So, here are 20 times history taught that lesson the hard way.

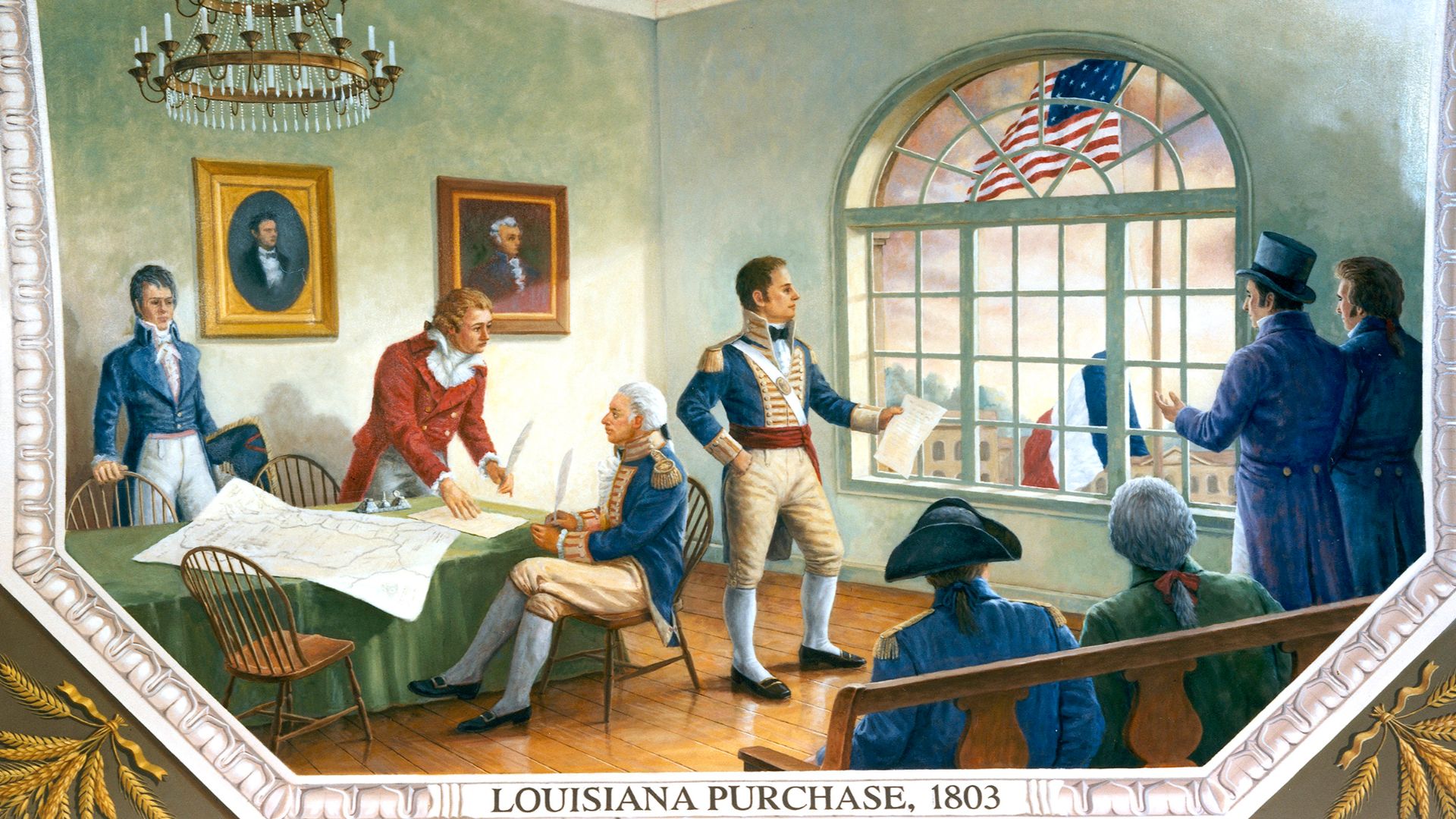

1. Napoleon’s Sale Of Louisiana For Pennies

In 1803, Napoleon sold the Louisiana Territory to the United States for $15 million—roughly 3 cents per acre. The purchase doubled the size of the country. Facing costly European wars and discouraged by the Haitian Revolution, Napoleon gave up North American ambitions.

2. The East India Company’s Opium Trade Miscalculation

The East India Company forced opium into China. This aggressive move triggered the First Opium War in 1839, draining British resources. Although the Treaty of Nanking favored Britain, the long-term instability it caused outweighed the short-term gains.

Painted by Captain John Platt, Bengal Volunteers. Engraved by John Burnet. on Wikimedia

Painted by Captain John Platt, Bengal Volunteers. Engraved by John Burnet. on Wikimedia

3. Ford’s Edsel Launch That Burned Millions

Released in 1957 and pulled by 1960, the Edsel cost Ford a staggering $250 million—over $2.6 billion today. Marketed as futuristic, it completely missed the mark with consumers. Hence, it remains a textbook example of corporate misjudgment.

4. The $100 Billion AOL-Time Warner Merger Disaster

In 2000, AOL acquired Time Warner using inflated stock in the dot-com bubble. The merger quickly unraveled as culture clashes surfaced. AOL’s value dropped sharply within years, which led to one of the largest corporate write-downs ever recorded.

Comcast Corporation on Wikimedia

Comcast Corporation on Wikimedia

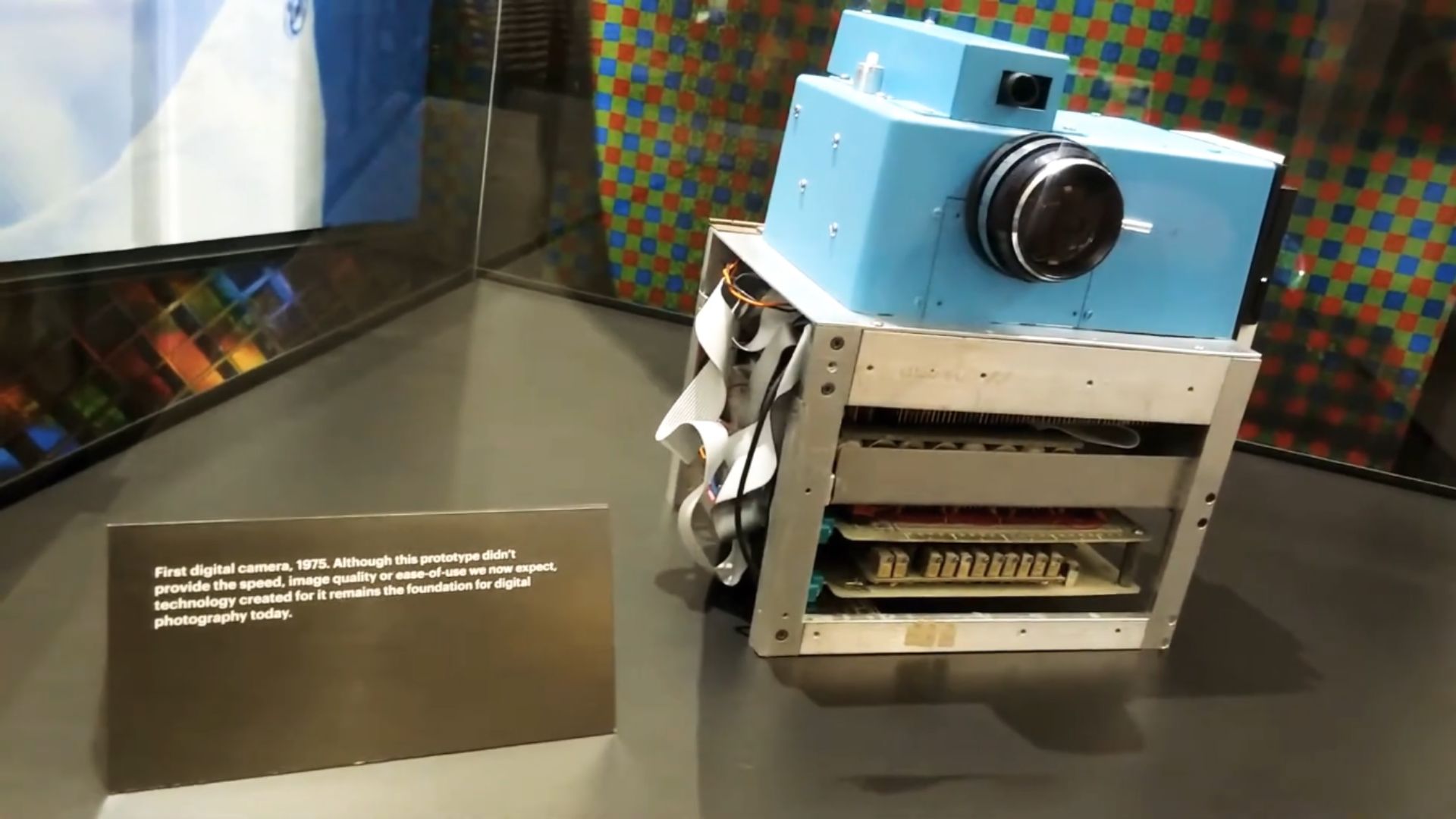

5. Kodak’s Rejection Of The Digital Camera

Kodak made the first digital camera in 1975 but chose to shelve it, fearing damage to its film business. That decision backfired as digital photography surged in the 2000s. By 2012, Kodak filed for bankruptcy, losing its lead to competitors.

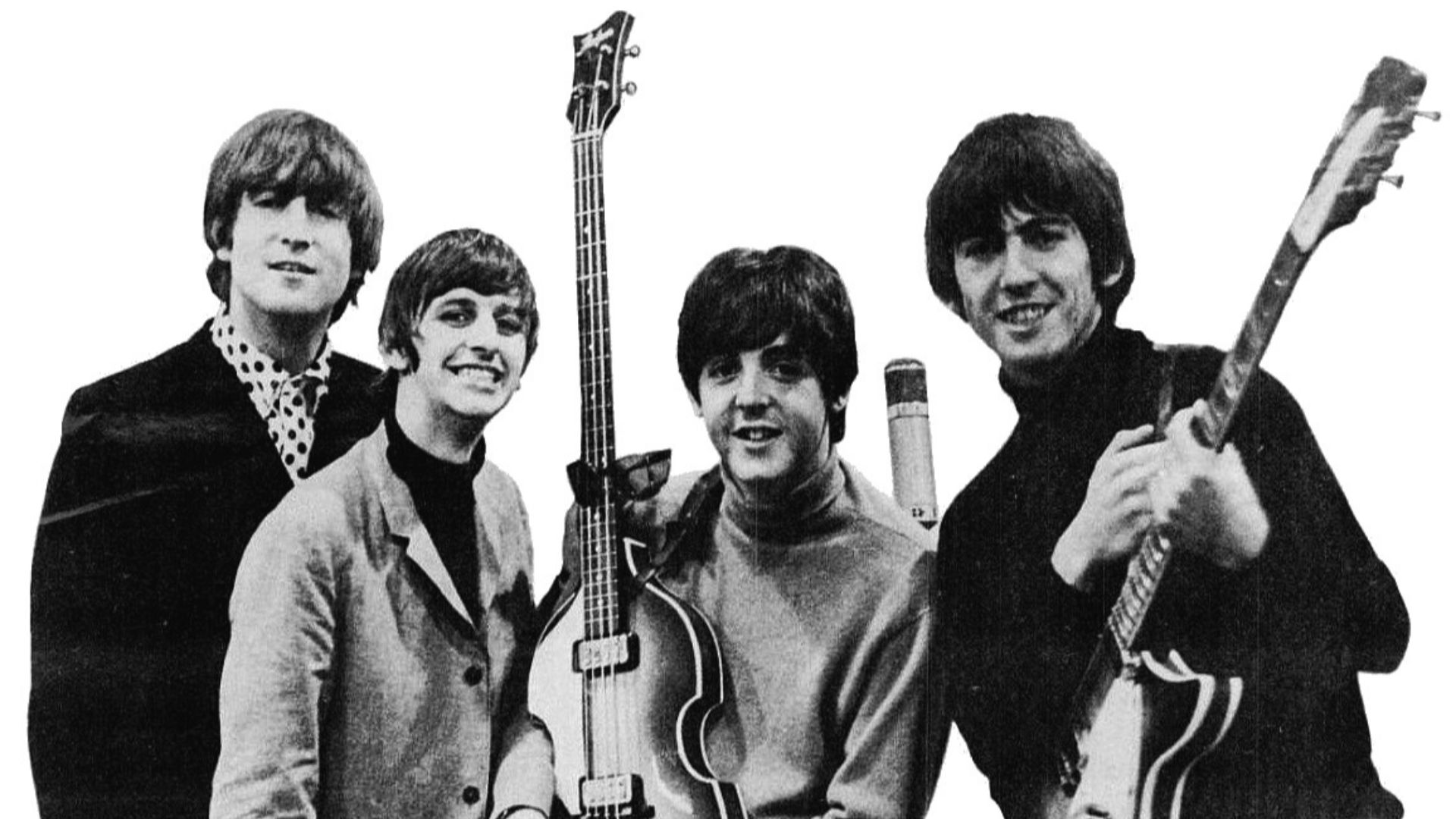

6. Decca Records Passing On The Beatles

Decca Records famously rejected The Beatles, claiming “guitar groups are on the way out.” They chose Brian Poole and the Tremeloes instead. Meanwhile, The Beatles signed with EMI’s Parlophone and changed music history, and Decca missed out on billions.

7. Yahoo Refusing To Buy Google For $1 Million

Back in 1998, Google approached Yahoo with a $1 million sale offer. Yahoo passed, thinking it wasn’t worth the cost. That decision aged poorly—Google went on to dominate search, ads, and tech valuation, leaving Yahoo far behind.

8. Blockbuster Turning Down Netflix’s Offer

In 2000, Netflix offered itself to Blockbuster for $50 million. Blockbuster dismissed the offer and stuck to physical rentals. Netflix adapted, embraced streaming, and took over the market. By 2010, Blockbuster went bankrupt and was left with a single store.

9. Lehman Brothers Ignoring Subprime Risk

Lehman Brothers heavily invested in subprime mortgages and ignored warning signs of financial instability. Overleveraged and exposed, the firm collapsed in September 2008—the largest bankruptcy in U.S. history. Its downfall sparked global panic, wiping out trillions.

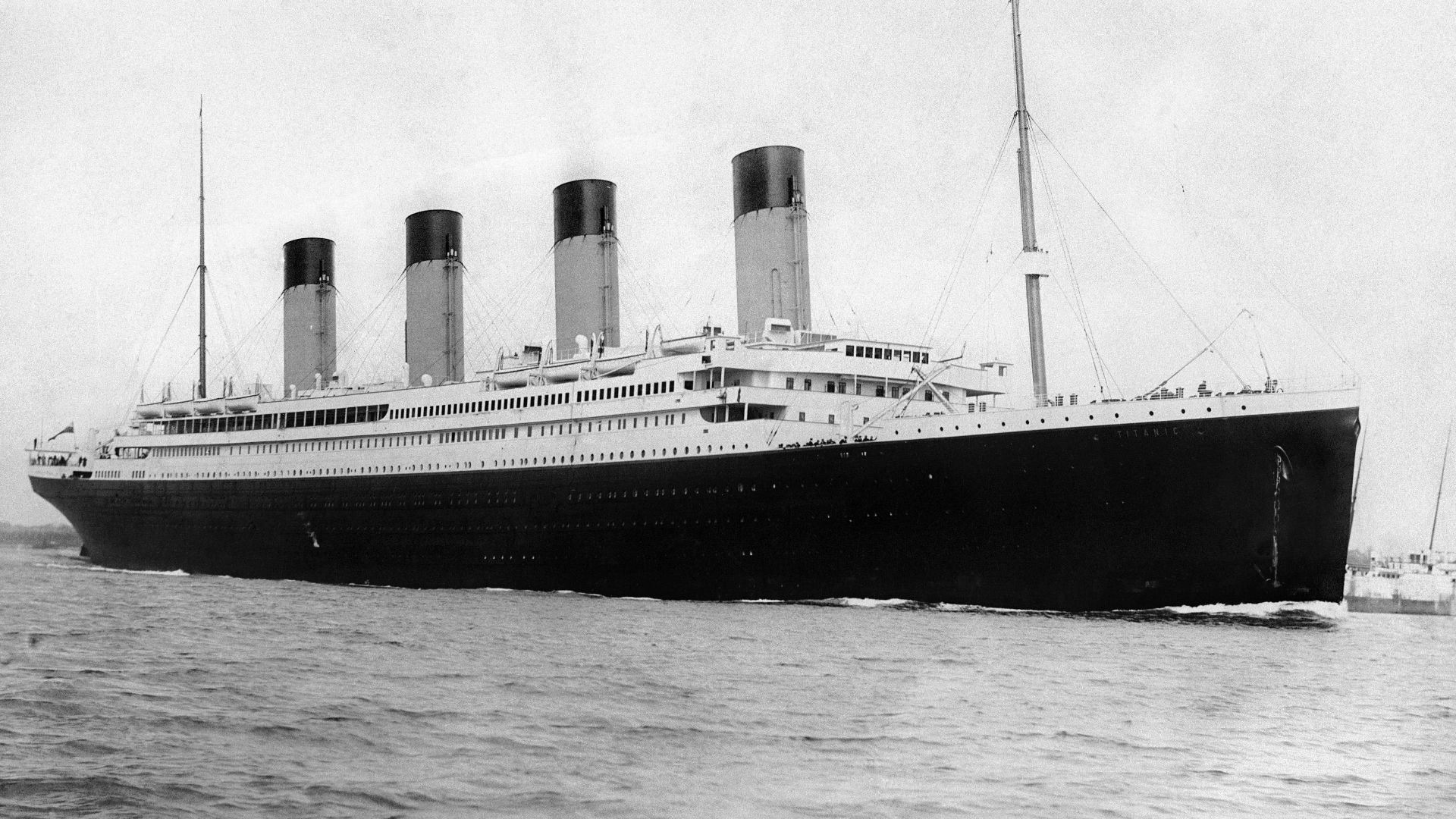

10. Titanic’s Cost-Cutting On Lifeboats

The Titanic sailed with lifeboats for 1,178 passengers—far short of the 2,224 on board. Prioritizing cost savings, the company downplayed safety. Ignored iceberg warnings sealed its fate in 1912, killing over 1,500 and dealing White Star Line lasting financial damage.

Francis Godolphin Osbourne Stuart on Wikimedia

Francis Godolphin Osbourne Stuart on Wikimedia

11. The Dutch Tulip Mania Crash Of 1637

In early 1637, tulip bulb prices skyrocketed—some selling for the price of an Amsterdam home. Within weeks, the market collapsed, wiping out fortunes and shocking speculators. As one of history’s first recorded bubbles, it shattered trust in speculative investing.

Jan Brueghel the Younger on Wikimedia

Jan Brueghel the Younger on Wikimedia

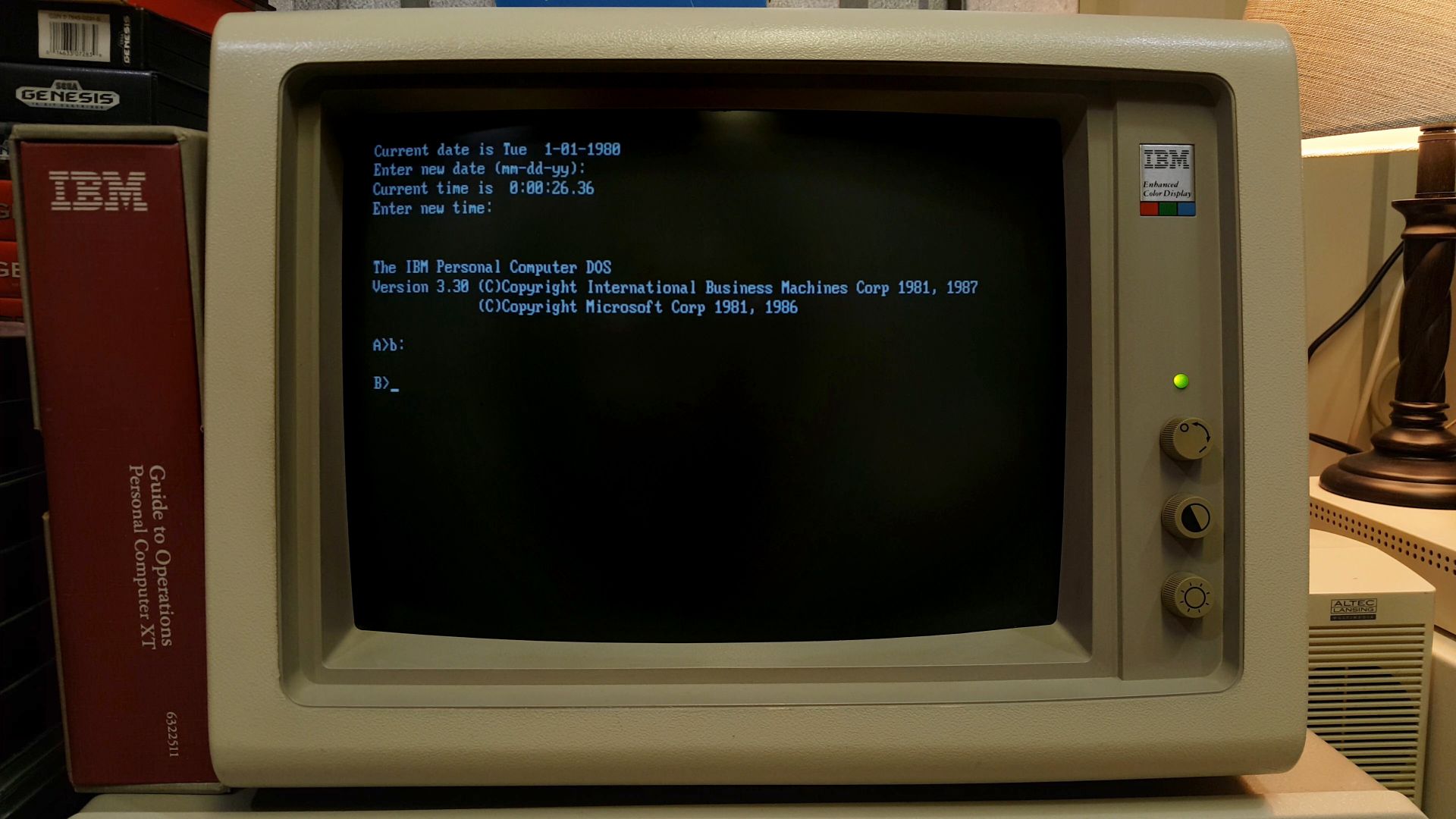

12. IBM Giving Microsoft The PC OS Contract

What seemed like a routine deal in 1980 changed tech history. IBM hired Microsoft to develop PC-DOS but let them keep the rights. Microsoft licensed it widely, dominating the OS market. IBM missed software’s true value, while Microsoft rose to a $3.2 trillion empire by 2025.

13. British South Sea Bubble Financial Collapse

The South Sea Company’s promises in 1720 sparked a frenzy. Backed by corruption, its stock price soared—then collapsed. British investors lost fortunes, and even members of Parliament were implicated. The fallout led to lasting skepticism toward investment schemes.

Edward Matthew Ward on Wikimedia

Edward Matthew Ward on Wikimedia

14. The Exxon Valdez Oil Spill Cleanup Bill

Back in 1989, the Exxon Valdez tanker spilled 11 million gallons of oil into the clear waters of Alaska’, blackening over 1,300 miles of coastline. Cleanup efforts spiraled past $2 billion, but the real mess was Exxon’s image—crippled by a sluggish response and capped off with $507 million in damages.

15. Russia Selling Alaska For $7.2 Million

Imagine selling off a treasure chest before checking what’s inside. That’s exactly what Russia did in 1867, trading Alaska to the U.S. for $7.2 million. It seemed worthless then, but oil, gold, and strategic value quickly transformed it into a historic blunder.

Emanuel Leutze (d. 1868) on Wikimedia

Emanuel Leutze (d. 1868) on Wikimedia

16. The Challenger Launch Despite Warning Signs

Sometimes, the rush to stay on schedule costs more than time. In 1986, NASA launched Challenger despite engineers’ warnings about faulty O-rings in the cold. Just 73 seconds in, the shuttle exploded, exposing deep cracks in NASA’s risk management culture.

17. Enron’s Fake Profits That Sparked Collapse

At its peak, Enron dazzled Wall Street as the U.S.'s 7th largest company until the numbers turned out to be smoke and mirrors. Shady accounting hid massive debt, and by 2001, it all unraveled. Due to this, billions were lost, and reform laws quickly passed.

18. Volkswagen’s Emissions Scandal Fines

What started as a clean diesel campaign turned into one of the auto industry's biggest deceptions. This happened when Volkswagen was exposed for rigging 11 million vehicles with software made to cheat emissions tests. The fallout was massive—over $30 billion in penalties.

U.S. Customs and Border Protection on Wikimedia

U.S. Customs and Border Protection on Wikimedia

19. Daimler’s $36 Billion Chrysler Merger Mistake

Touted in 1998 as a “merger of equals,” Daimler’s $36 billion union with Chrysler quickly drove off course. Cultural clashes and misaligned operations sank synergy hopes. By 2007, Daimler unloaded most of Chrysler for just $7.4 billion.

20. The Concorde Jet’s Financial Crash Landing

Born of ambition and speed, the Concorde took flight in 1976 as a joint British-French marvel. But high ticket prices and rising costs clipped its wings. After just 14 jets and a tragic crash in 2000, the sleek dream retired quietly in 2003.

KEEP ON READING

20 Greek Gods We Don't Often Talk About

Step Aside, Zeus. Greek mythology isn’t only about Zeus and…

By Elizabeth Graham Jan 16, 2026

10 Historic Courtship Practices That Should Be Brought Back &…

Old-School Dating Was a Mix of Charming & Unhinged. Historic…

By Emilie Richardson-Dupuis Jan 20, 2026

Legendary Tales: 20 Most Fascinating Mythical Creatures from Folklore

Mythological Beasts. Stories about mythical creatures endure for a simple…

By Christy Chan Jan 16, 2026

20 Areas With The Most Dinosaur Bones Worldwide

Why These Places Are Fossil Goldmines. If you’ve ever wondered…

By Elizabeth Graham Jan 26, 2026

The 20 Craziest Silent Films Ever Made

When Silence Let the Madness Speak. Silent cinema didn’t just…

By Chase Wexler Jan 5, 2026

10 Things Gladiator Got Right About Ancient Rome & 10…

Between Historical Truth and Cinematic Illusion. Ridley Scott’s Gladiator won 5 Academy…

By Chase Wexler Jan 17, 2026